Avianca Holdings S.A. (AVH) (the "Company" or "Avianca") (NYSE: AVH, BVC: PFAVH) today announced the expiration and final results with respect to its offer to exchange (the "Exchange Offer") any and all of its existing 8.375% Senior Notes due 2020 (the "Existing Notes") for new 8.375% Senior Secured Notes due 2020 (the "Exchange Notes").

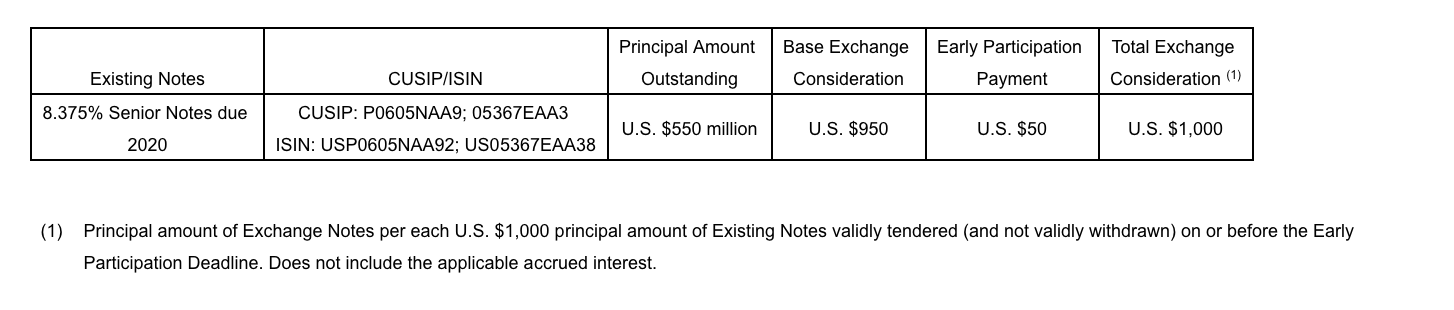

As of 12:01 a.m., New York City time, on November 1, 2019 (the "Expiration Deadline"), $484,419,000 aggregate principal amount of Existing Notes, representing approximately 88.1% of the total outstanding principal amount of the Existing Notes, had been validly tendered for exchange and not validly withdrawn, as confirmed by the information agent for the Exchange Offer. All holders who tendered as of the Expiration Deadline will receive the "Total Exchange Consideration," as set forth in the table below, per $1,000 of Existing Notes, plus accrued and unpaid interest in cash on Existing Notes accepted for exchange through, but not including, the settlement date for the Exchange Offer.

Avianca also announced today that all conditions required to consummate the Exchange Offer have been satisfied. Accordingly, the settlement date of the Exchange Offer will be today, November 1, 2019. $484,419,000 aggregate principal amount of Exchange Notes will be issued.

The Exchange Offer was made, and the Exchange Notes were offered and issued, only (a) in the United States to holders of Existing Notes who are "qualified institutional buyers" (as defined in Rule 144A under the Securities Act of 1933, as amended (the "Securities Act")) in reliance upon the exemption from the registration requirements of the Securities Act and (b) outside the United States to holders of Existing Notes who are persons other than "U.S. persons" (as defined in Rule 902 under the Securities Act) in reliance upon Regulation S under the Securities Act.