American Airlines Group Inc. (NASDAQ:AAL) today reported its third-quarter 2017 results, including these highlights:

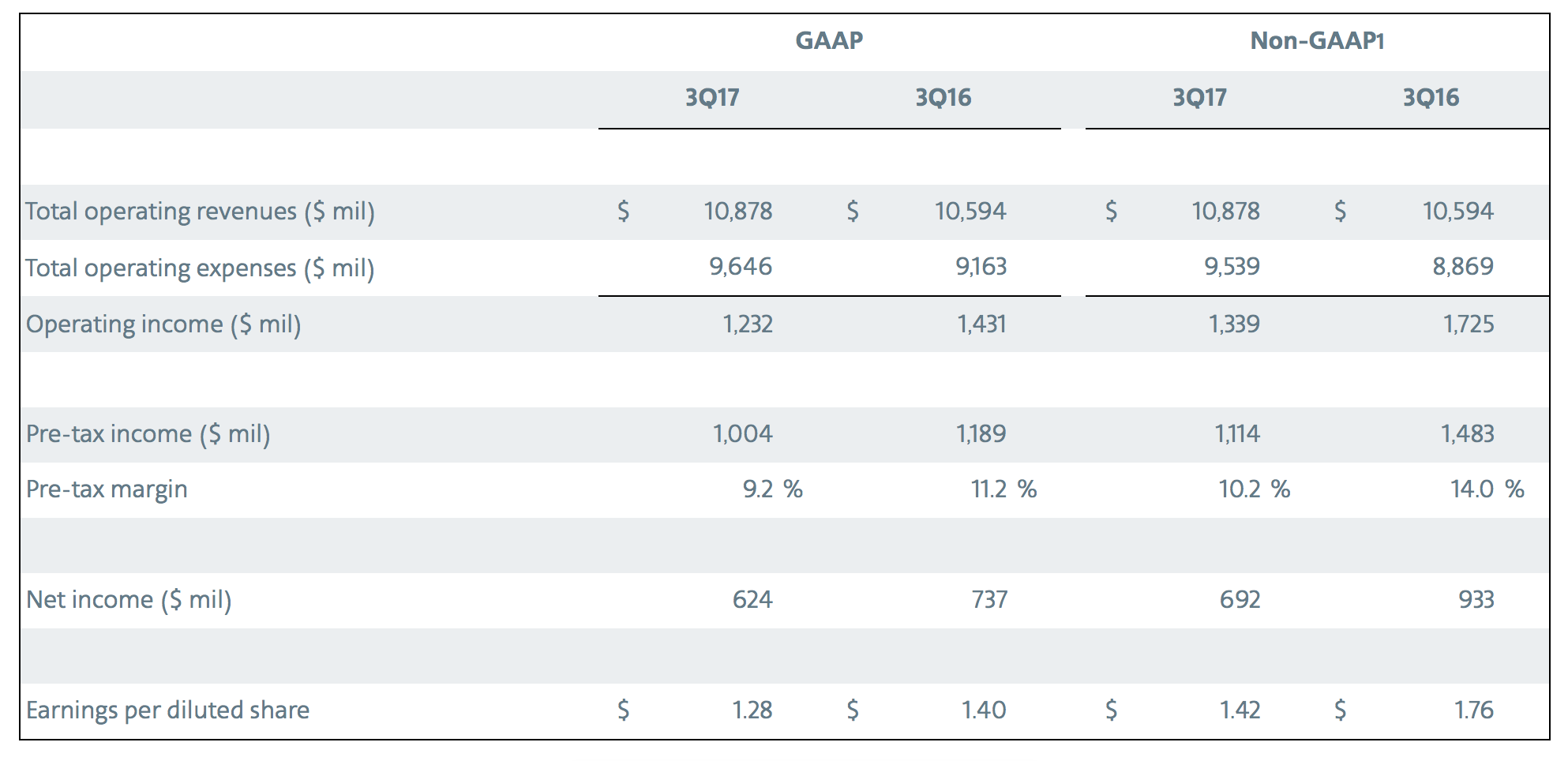

- Recorded a third-quarter 2017 pre-tax profit of $1.0 billion, or $1.1 billion excluding net special items,1 and net profit of $624 million, or $692 million excluding net special items

- Reported third-quarter earnings of $1.28 per diluted share, or $1.42 per diluted share excluding net special items

- Reported a 2.7 percent increase in total revenue, to $10.9 billion, and a 1.1 percent increase in total revenue per available seat mile (TRASM) for the third quarter

- Returned $411 million to stockholders in the third quarter through the repurchase of 7.7 million shares for $362 million and dividend payments of $49 million

- Pre-tax earnings excluding net special items for the third quarter of 2017 were $1.1 billion, a $369 million decrease from the third quarter of 2016. During the third quarter, the company’s operations were affected by Hurricanes Harvey, Irma and Maria, causing more than 8,000 flight cancellations, and reducing pre-tax earnings by an estimated $75 million.

“Despite the significant operational challenges posed by three hurricanes, our team delivered solid financial results,” said Chairman and CEO Doug Parker. “The hurricane response highlighted the humanity and professionalism of the American team, and our industry as a whole.”

“We especially want to acknowledge the burden placed on our team members in Puerto Rico and throughout the Caribbean. The generous spirit of the American Airlines team was on full display as team members in Miami, Chicago and elsewhere packed meals and care packages for our colleagues and our customers in Puerto Rico. We also capped fares for customers traveling to and from the regions hit by these storms,” Parker said.

Revenue and Expenses

ontinued strong demand for air travel and improving yields drove a 2.7 percent year-over-year increase in total revenue, to $10.9 billion. For the first time since the second quarter of 2014, yield grew in every geographic region, with notable strength in Latin America. Cargo revenue was up 17.0 percent to $200 million due to a 19.2 percent increase in cargo ton miles. Other revenue was up 2.2 percent to $1.3 billion. Third-quarter TRASM increased by 1.1 percent on a 1.6 percent increase in total available seat miles.

Total third-quarter operating expenses were $9.6 billion, up 5.3 percent year-over-year due primarily to a 13.3 percent increase in consolidated fuel expense and an 8.0 percent increase in salaries and benefits resulting from the company’s investments in its team members. Total third-quarter cost per available seat mile (CASM) was 13.20 cents, up 3.6 percent. Excluding fuel and special items, total CASM was 10.43 cents, up 4.5 percent.

“We are playing the long game at American to create value in an industry that has been fundamentally transformed,” said Parker.

Strategic Objectives

At American’s Media & Investor Day last month, the company laid out four long-term strategic objectives: Build a World-Class Product, Drive Efficiencies, Make Culture a Competitive Advantage, and Think Forward, Lead Forward.

Build a World-Class Product

American continues to make significant investments in the premium travel experience. In August, the company opened a new Admirals Club lounge in Terminal 5 at Los Angeles International Airport, and in September, the company opened a new Flagship Lounge at Chicago O’Hare International Airport. American plans to open new Flagship Lounges with Flagship First Dining in Miami and Los Angeles later this quarter.

Demand for American’s highly-differentiated Premium Economy travel experience remains high. Offered on international flights, Premium Economy comes with a wider seat, more legroom, an amenity kit, and enhanced meal choices. American is pleased with the customer adoption of this product as it generates an average premium of more than $400 each way over Main Cabin fares. The company’s fleet now has Premium Economy seats on 27 of its widebody aircraft, with plans to retrofit most of its remaining widebodies by the end of 2018.

In early September, American expanded its Basic Economy product throughout the continental United States. Basic Economy allows American to compete with ultra-low cost carriers while still offering a better product. Initial results of this new product’s rollout continue to be consistent with management’s expectations, with approximately half of American Airlines customers buying up to Main Cabin when given the option between that and Basic Economy.

“Continued product differentiation and a comprehensive network are just two of the ways American is setting itself apart. And we know we can do more. We have identified nearly $3 billion of revenue opportunities through 2021, including product segmentation, co-branded partnerships, and harmonizing our seating configurations across the fleet,” said American Airlines President Robert Isom.

Drive Efficiencies

As part of the company’s ongoing fleet renewal program, during the third quarter, American invested more than $900 million in 13 new mainline aircraft and three regional aircraft, including taking delivery of its first Boeing 737 MAX aircraft. These new, larger and more fuel efficient aircraft continue American’s fleet transformation and will replace aircraft that are expected to leave the fleet. In total, the company has invested more than $18 billion in new aircraft since the merger, giving it the youngest fleet of its network peers.

“We are focused on driving efficiencies and maximizing value for our investors. As we plan for the future, we have identified more than 400 efficiency-related projects which we estimate will provide $1 billion of benefit over the next four years. Examples include fuel initiatives, flight and route planning, improved schedule seasonality, and using our airport assets more productively,” said Chief Financial Officer Derek Kerr.

Make Culture a Competitive Advantage

Making culture a competitive advantage starts with leadership that cares for frontline team members. During the quarter, American expanded its Lead the Experience leadership training beyond corporate officers, and will expand this training further next year. In addition, American continues to roll out service training to frontline team members and anticipates 35,000 airport and reservation team members will have received this training by the end of this year, with plans to roll this training out further in 2018. Earlier this week, the company launched its first employee survey in well over a decade, which will provide more information to support frontline team members.

"We are building an environment where our leaders enthusiastically embrace the responsibility of caring for and inspiring our frontline team members. This environment includes a new technology platform for all team member data, development and training for our leaders, and investments in our team,” said Elise Eberwein, Executive Vice President of People and Communications.

Think Forward, Lead Forward

American has expanded the use of self-service technology during irregular operations, which enables customers to rebook on alternative flights and arrange for delivery of delayed bags from the convenience of a mobile device. This new technology gives customers more accurate, real-time information and options that work for them during difficult weather situations. This automation also frees up time for the company’s customer service team members to solve more complex issues.

“With the pace at which the world moves today, we know our technology solutions have to come faster, and they have to be adaptable across a variety of devices, including on-board handhelds, tablets, desktops and personal mobile devices. We are bringing more of our systems into the cloud environment, which enables us to deliver more, and finish projects faster,” said Maya Leibman, Chief Information Officer. “All of our work comes back to making it easier for our team members to do their jobs, and making it easier for our customers to fly with American, and we are making significant improvements in both of these areas.”

Hurricane Response

American Airlines team members have worked together to help the people of San Juan, Puerto Rico and other affected parts of the Caribbean. American was the first commercial airline to restore service to San Juan after Hurricane Maria. American and its team members have delivered more than 2.5 million pounds of relief supplies and raised almost $2 million for the American Red Cross. In addition, team members in Chicago, New York, Fort Worth and Miami volunteered to pack more than 100,000 meals for hurricane victims, as well as 2,000 kits for military men and women currently serving in San Juan.

Over recent weeks, Tech Ops team members sent and served 600 hot meals for colleagues in San Juan. American Airlines team members have contributed more than $350,000, which American has matched, to the American Airlines Family Fund during the recent hurricane season. The Family Fund provides monetary relief to team members facing catastrophic and life-altering emergencies.

Capital Investments and Shareholder Returns

Since mid-2014, American has returned more than $11.1 billion to stockholders primarily through share repurchases and dividends, and reduced its share count by 37 percent to 480.0 million shares. As of September 30, 2017, the company had approximately $677 million remaining of its $2.0 billion share repurchase authority.2

The company declared a dividend of $0.10 per share, to be paid on November 27, 2017, to stockholders of record as of November 13, 2017.

Guidance and Investor Update

American expects its fourth-quarter TRASM to increase approximately 2.5 to 4.5 percent year-over-year, which reflects continued improvement in demand for both business and leisure travel. The company also expects its fourth-quarter pre-tax margin excluding special items to be between 4.5 and 6.5 percent.3

For additional financial forecasting detail, please refer to the company’s investor relations update, filed with the Securities and Exchange Commission on Form 8-K. This filing will be available at aa.com/investorrelations.

Conference Call / Webcast Details

The company will conduct a live audio webcast of its earnings call today at 9:00 a.m. CT, which will be available to the public on a listen-only basis at aa.com/investorrelations. An archive of the webcast will be available on the website through November 26.