American Airlines Group Inc. (NASDAQ:AAL) today reported its fourth-quarter and full year 2017 results, including these highlights:

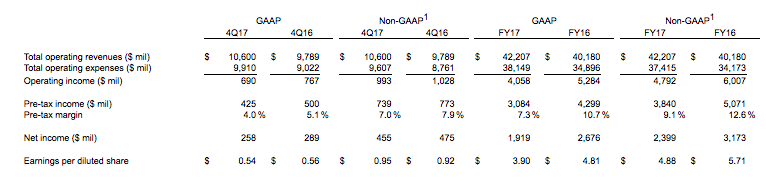

Reported a full year 2017 pre-tax profit of $3.1 billion, or $3.8 billion excluding net special items1, and a full year net profit of $1.9 billion, or $2.4 billion excluding net special items

Reported a fourth-quarter 2017 pre-tax profit of $425 million, or $739 million excluding net special items, and a fourth-quarter net profit of $258 million, or $455 million excluding net special items

2017 earnings were $3.90 per diluted share, or $4.88 per diluted share excluding net special items. Fourth-quarter earnings were $0.54 per diluted share, or $0.95 per diluted share excluding net special items

Accrued $241 million for the company’s profit sharing program in 2017, including $46 million in the fourth quarter

Returned $1.7 billion to shareholders in 2017, including the repurchase of 33.9 million shares and dividend payments of $198 million

Pre-tax earnings excluding net special items for the fourth quarter of 2017 were $739 million, a $34 million decrease from the fourth quarter of 2016. For the full year 2017, pre-tax earnings excluding net special items were $3.8 billion, a decrease of $1.2 billion from 2016.

“2017 was a remarkable year for American Airlines. We made enormous progress as a company as we continued to make significant investments in our team members, product and operation, and those investments are beginning to pay off,” said Chairman and CEO Doug Parker. “Our operation continues to deliver record-setting performance for the company, and the credit goes to our team members who are simply the best in the business.

“We enter 2018 with strong momentum. Demand for American’s reliable, friendly service remains strong, our network is expanding, and the products we are bringing to market are resonating with customers.”

Fourth-Quarter and Full Year 2017 Revenue and Expenses

Strong close-in demand and improving yields drove an 8.3 percent year-over-year increase in fourth-quarter total revenue, to $10.6 billion. Passenger yields grew in all geographic regions, including 11.0 percent growth in trans-Atlantic and 7.9 percent growth in Latin America. Cargo revenue was up 19.7 percent to $232 million due to higher volumes and a 6.7 percent increase in cargo yield. Other revenue was up 8.1 percent to $1.3 billion. Fourth-quarter total revenue per available seat mile increased by 5.6 percent compared to 2016 on a 2.5 percent increase in total available seat miles.

Total fourth-quarter operating expenses were $9.9 billion, up 9.8 percent year-over-year due primarily to a 23.5 percent increase in consolidated fuel expense and a 7.0 percent increase in salaries and benefits resulting from the company’s investments in its team members. Total fourth-quarter cost per available seat mile (CASM) was 14.71 cents, up 7.1 percent from fourth-quarter 2016. Excluding fuel and special items, total fourth-quarter CASM was 11.25 cents, up 3.8 percent year-over-year.

Strategic Objectives

The company continues to focus on four long-term strategic objectives: Create a World-Class Customer Experience, Make Culture a Competitive Advantage, Ensure Long-Term Financial Strength, and Think Forward, Lead Forward.

Create a World-Class Customer Experience

American began 2017 by being named Air Transport World’s Airline of the Year in recognition of its successful integration and significant investment in its product and people. This is a recognition American had not received since 1988. Also in 2017, American:

Recorded its best on-time departure and arrival performance since 2003, and its best baggage handling performance since DOT began reporting in 1994

Launched new products to meet customer demand, including the expansion of American’s best-in-class lounges by opening Flagship First Dining, a new exclusive experience for customers in First Class on international and A321T transcontinental flights. American now offers Flagship First Dining in Miami, Los Angeles, and New York- JFK. Importantly, American is the only U.S. airline that offers international First Class

Operated the youngest fleet among its peers and invested $4.1 billion in new aircraft, including its first Boeing 737 MAX. By the end of 2018, the company expects to induct a total of 20 new MAX aircraft, which will replace older, less fuel efficient aircraft

Introduced new streaming-capable satellite-based internet access on the 737 MAX, which will be rolled out across most of the domestic mainline fleet

Introduced Basic Economy, a product to compete with ultra low-cost carriers. This product is now offered nationwide and to leisure markets in Mexico and most of the Caribbean

Rolled out Premium Economy, which offers a wider seat, more legroom, an amenity kit, and enhanced meal choices on international flights. Currently 64 widebody aircraft offer this product. American expects to offer Premium Economy on most of its widebody fleet by the spring of 2019

Expanded the airline’s global footprint by launching Los Angeles-to-Beijing service; and announcing service from Philadelphia to Prague, Czech Republic, and Budapest, Hungary; Dallas-Fort Worth to Reykjavik-Keflavik, Iceland; and Chicago-O’Hare to Venice, Italy, which will start this summer

Completed delivery of the last Boeing 737-800 and Airbus A321CEO aircraft

Painted the last aircraft in American’s new livery

“Customers are responding positively to the options American offers, from international First Class to Basic Economy,” said American Airlines President Robert Isom. “We are far ahead of our U.S. competitors in offering Premium Economy on our international flights, which comes just as we begin to prepare for the busy summer travel season. Importantly, this highly-differentiated product makes American’s international service consistent with its partners across the Atlantic and the Pacific, so customers can book their international Premium Economy trips seamlessly.

“American’s customers are noticing these significant product and network improvements. 2017 survey scores measuring our customers’ likelihood to recommend American were the highest they’ve been in company history,” Isom said.

Make Culture a Competitive Advantage

American is creating an environment that cares for frontline team members, provides competitive pay, and equips its team with the right tools to support its customers. During 2017, American:

Awarded each team member with two complimentary round-trip tickets across American’s global network to commemorate being named Air Transport World’s 2017 Airline of the Year

After hurricanes hit the Caribbean and Florida, American Airlines team members worked together to help the people of San Juan, Puerto Rico and other affected parts of the region. American and its team members have delivered more than 2.5 million pounds of relief supplies and raised almost $2 million for the American Red Cross, in addition to other relief work

Invested more than $300 million in facilities and equipment including renovations to team member spaces, mobile devices for pilots and flight attendants, and the ongoing One Campus One Team initiative at the airline’s global support center in Fort Worth

Ensured team member pay remained competitive through initiatives such as a mid-contract salary increase for pilots and flight attendants and continued step increases from a mid-contract pay increase for mechanics and fleet service workers

Introduced a best-in-industry maternity and adoption benefit program to all team members including union-represented team members

Launched the company’s first team member survey in over a decade

Provided customer service skills training to 35,000 team members through Elevate the Everyday Experience training, and launched training for leaders that emphasizes supporting team members who directly serve customers

Announced that work on its CFM56-5B engines, which power much of American’s Airbus narrowbody fleet, would move in-house to its world-class maintenance team located in Tulsa, Oklahoma beginning later this year

Just this month, shared benefits of the recent Tax Cuts and Jobs Act by issuing $1,000 payments to all non-officer team members at American and its wholly-owned regional carriers. While American does not yet pay federal cash income taxes, the new tax law will reduce the company’s future tax bill and allow more investments in equipment and facilities

Ensure Long-Term Financial Strength

American has taken significant steps forward to ensure its long-term competitiveness in the global aviation industry. In the four full years since the merger closed, the company’s cumulative pre-tax earnings excluding net special items were $19.4 billion. American is focused on capturing the efficiencies created by the merger, delivering on its earnings potential, and creating value for its owners. In 2017, American:

Returned $1.7 billion to shareholders through share repurchases and dividends, bringing the total since mid-2014 to $11.4 billion. These repurchases have reduced the share count by 37 percent to 475.5 million shares at the end of 2017. As of December 31, 2017, the company had approximately $450 million remaining of its current $2.0 billion share repurchase authority2

Announced, at American’s Media & Investor Day last fall, $3.9 billion in revenue and cost initiatives expected to be realized by the end of 2021. These projects are on track and are expected to improve the customer experience, drive revenue improvements, and deliver cost efficiencies

Completed several innovative and landmark transactions in 2017 that provided efficient financing for the company. These transactions included repricing approximately $5 billion in term loans at industry-leading rates, extending and increasing its revolving credit facility, and setting a new benchmark rate for subordinated aircraft debt in the EETC market

On January 25, 2018, declared a dividend of $0.10 per share, to be paid on February 20, 2018, to stockholders of record as of February 6, 2018

Think Forward, Lead Forward

American is committed to re-establishing itself as an industry leader by creating an action-oriented culture that moves quickly to bring products to market, embraces technological change, and quickly seizes upon new opportunities for its network and product. In 2017, American:

Announced a $200 million equity stake in China Southern Airlines, leading to a growing codeshare with the largest airline in China

Executed an amended and restated trans-Atlantic Joint Business Agreement that extends the term of the agreement with the company’s partners

Adopted next-generation technology such as cloud hosting and machine learning to speed time to value

Announced a commitment for more than $1.6 billion for improvements of LAX Terminals 4 and 5, setting the stage for American to receive additional gate space, strengthen its Pacific gateway and to be the pre-eminent airline for Los Angeles

Built a five-gate expansion at Chicago O’Hare Terminal 3, which is expected to open in April, giving American a new advantage at this key competitive hub

Parker summarized: “As an airline, we will always operate in a just-in-time environment, however, we recognize we must lead for the long term. This means we must be more nimble in our problem solving and in how we innovate and develop the right products, technology, and network both for customers of today and the future. Ultimately, all of this work will produce a company built for the long term, led by a team that thinks long-term, sees the potential of future opportunities, and brings innovative concepts to market quickly and efficiently.”

Guidance and Investor Update

American expects its first-quarter 2018 TRASM to increase approximately 2.0 to 4.0 percent year-over-year, which reflects expected continued improvement in demand for both business and leisure travel. The company also expects its first-quarter 2018 pre-tax margin excluding special items to be between 2.0 and 4.0 percent.3 In addition, based on the guidance issued today and current business conditions, American presently expects its 2018 diluted earnings per share excluding net special items to be between $5.50 and $6.50. 3

For additional financial forecasting detail, please refer to the company’s investor relations update, filed with the Securities and Exchange Commission on Form 8-K. This filing will be available at aa.com/investorrelations.