FORT WORTH, Texas — American Airlines Group Inc. (NASDAQ: AAL) today reported its first-quarter 2019 results, including these highlights:

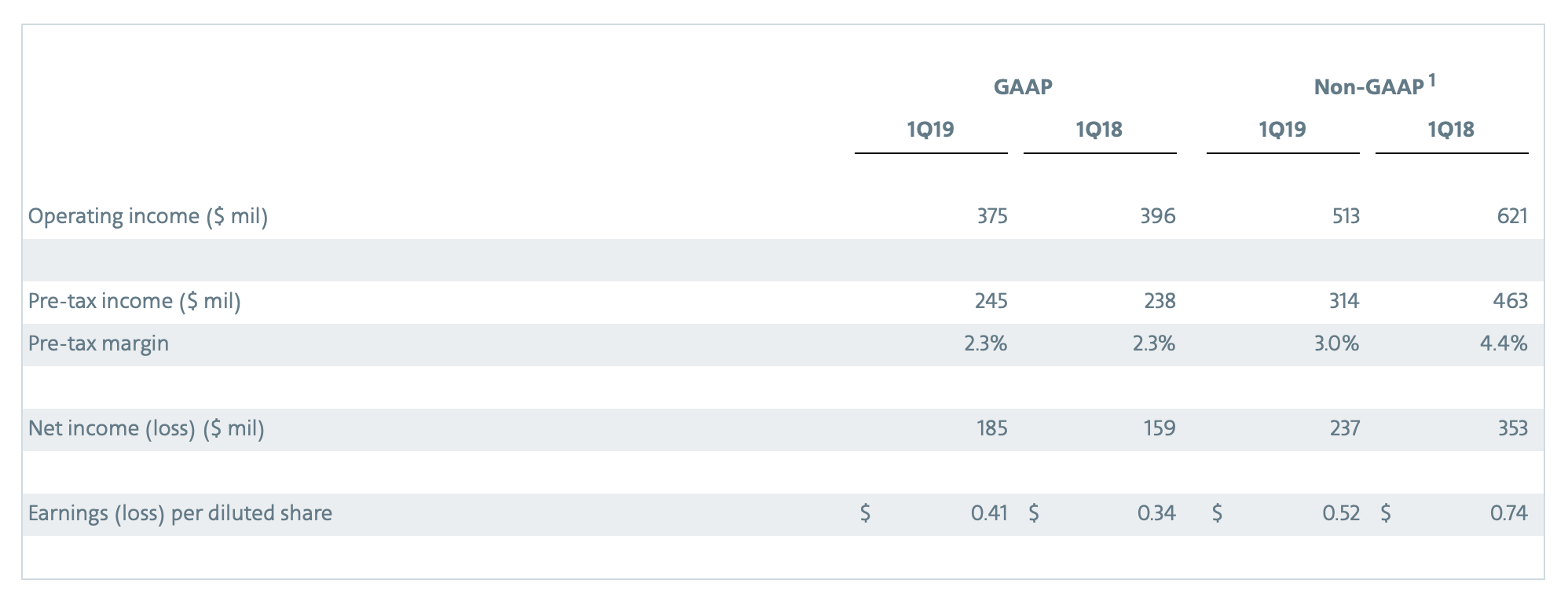

Reported a first-quarter 2019 pre-tax profit of $245 million, or $314 million excluding net special items1, and a first-quarter net profit of $185 million, or $237 million excluding net special items1

First-quarter earnings were $0.41 per diluted share, or $0.52 per diluted share excluding net special items1

Reported record first-quarter revenue of $10.6 billion. Also reported record first-quarter total revenue per available seat mile (TRASM) — the 10th consecutive quarter of TRASM growth

Returned $646 million to shareholders in the form of dividends and share repurchases in the first quarter

“We want to thank our 130,000 team members for the outstanding job they did to take care of our customers, despite the challenges with our fleet during the quarter. Their hard work led American to record revenue performance under difficult operating conditions,” said Chairman and CEO Doug Parker.

“As we progress toward the busy summer travel period, demand for our product remains strong. However, our near-term earnings forecast has been affected by the grounding of our Boeing 737 MAX fleet, which we have removed from scheduled flying through Aug. 19. We presently estimate the grounding of the 737 MAX will impact our 2019 pre-tax earnings by approximately $350 million. With the recent run-up in oil prices, fuel expenses for the year are also expected to be approximately $650 million higher than we forecast just three months ago.

“Even with these challenges, we expect our 2019 earnings per diluted share excluding net special items2 to grow approximately 10% versus 2018,” Parker continued. “As we look forward to 2020 and beyond, we anticipate that our free cash flow production will increase significantly as our historic fleet replacement program winds down. We are very bullish on our future and focused on creating value for our shareholders.”

First-Quarter Revenue and Expenses

Pre-tax earnings excluding net special items for the first quarter of 2019 were $314 million, a $149 million decrease from the first quarter of 2018

Strong passenger demand drove a 1.8% year-over-year increase in first-quarter 2019 total revenue, to a first-quarter record $10.6 billion. Driven by a record first-quarter total passenger load factor of 82.2%, passenger revenue per available seat mile (PRASM) grew 0.6% to 14.49 cents. Cargo revenue decreased 4% to $218 million due in part to a 9.1% decrease in cargo ton miles. Other revenue was up 1.9% to $708 million due primarily to higher loyalty revenue. First-quarter TRASM increased by 0.5% to a record 15.87 cents on a 1.3% increase in total available seat miles. This marks the 10th consecutive quarter of TRASM growth for American.

Total first-quarter 2019 operating expenses were $10.2 billion, up 2% year-over-year. Total operating cost per available seat mile (CASM) was 15.31 cents in the first quarter of 2019, up 0.7% from first-quarter 2018. Excluding fuel and special items, first-quarter CASM was 11.88 cents, up 2.7% year-over-year, driven primarily by a higher volume of heavy maintenance checks.

Fleet Update

On March 7, the company announced the unplanned removal of 14 737-800 aircraft from service for remediation work following the installation of new aircraft interiors. This resulted in the cancellation of approximately 940 flights in the first quarter. Work on these aircraft has been completed and all aircraft have been returned to service.

In addition, on March 13, the Federal Aviation Administration (FAA) grounded all U.S.-registered 737 MAX aircraft. The American fleet currently includes 24 737 MAX 8 aircraft with an additional 76 aircraft on order. As a result, American canceled approximately 1,200 flights in the first quarter.

In aggregate, the company estimates that these grounded aircraft and associated flight cancellations impacted its first quarter pre-tax income by approximately $80 million.

The company has removed all 737 MAX flying from its flight schedule through Aug. 19, which is approximately 115 flights per day. These flights represent approximately 2% of American’s total capacity each day this summer. Although these aircraft represent a small portion of the company’s total fleet, its financial impact is disproportionate as most of the revenue from the cancellations is lost while the vast majority of the costs remain in place. In total, the company presently expects the 737 MAX cancellations, which are assumed to extend through Aug. 19, to impact its 2019 pre-tax earnings by approximately $350 million.

Strategic Objectives

American’s success is guided by three strategic objectives: Make culture a competitive advantage, create a world-class customer experience and build American Airlines to thrive forever.

Make Culture a Competitive Advantage

Taking care of team members translates into better customer care. We continue to invest in improved tools, training and support for team members and in the first quarter, American:

Opened a new 191,000-square-foot hangar in Chicago (ORD), reopened Tulsa Hangar 2 Dock 2D following its modification to accommodate larger aircraft and announced plans to hire 250 new aviation maintenance technicians (AMTs) this summer.

Hosted more than 5,000 leaders at the airline’s Annual Leadership Conference in Dallas. Team members who oversee people spent a full day learning about American’s mission to care for people on life’s journey.

Accrued $20 million for the company’s profit-sharing program.

Honored 100 team members at the company’s Annual Chairman’s Award celebration in Dallas earlier this month.

Raised $1.4 million for the Cystic Fibrosis Foundation.

Received recognition as a leader among U.S. companies in LGBTQ workplace policies for the 17th year in a row through the airline’s highest rating from the Human Rights Campaign in the 2019 Corporate Equality Index.

Create a World-Class Customer Experience

American has invested more than $28 billion in its people, product and fleet over the past five years — the largest investment of any carrier in commercial aviation history over this period. In the first quarter, American:

Took delivery of 15 new aircraft, including its first two Airbus A321neos, a fuel-efficient aircraft that has power at every seat, larger overhead bins and free wireless entertainment to each customer’s own device, including free live television.

Partnered with Apple Music to offer complimentary Wi-Fi access for customers to stream from their personal Apple Music accounts. Customers with Apple Music subscriptions can access their playlists for free onboard any domestic flight equipped with ViaSat satellite Wi-Fi.

Introduced new partnerships with Blade, offering helicopter transfers in Los Angeles (LAX) and New York (JFK), and The Private Suite at LAX, offering off-terminal entrance and private screening service.

Opened a newly renovated Terminal B in Boston (BOS) and a newly renovated Admirals Club in Concourse B in Charlotte (CLT).

Provided AAdvantage members more ways to earn miles with its enhanced relationship with Hyatt Hotels. Through this relationship, elite members in both the AAdvantage and World of Hyatt loyalty programs will be rewarded with more ways to earn points, miles and status on qualifying American flights and stays at Hyatt Hotels.

Build American Airlines to Thrive Forever

With a nearly 100-year legacy, American is building a company that we expect to be consistently profitable today and in the future. This long-term initiative was furthered during the quarter as American:

Returned $646 million to shareholders through the repurchase of 16.7 million shares and the payment of $46 million in dividends. The company has $1.1 billion remaining of its existing $2 billion share repurchase authorization3.

Expanded the codeshare and began offering reciprocal frequent flyer benefits with China Southern Airlines.

Submitted an application to the U.S. Department of Transportation (DOT) that proposes additional service to Tokyo Haneda (HND) from LAX, Dallas-Fort Worth (DFW) and Las Vegas (LAS). These slots would provide American’s customers better access to downtown Tokyo and to the domestic network of its Pacific Joint Business partner, Japan Airlines.

Announced a planned co-location with British Airways at Terminal 8 at JFK giving customers a unified experience. American and British Airways will invest $344 million in Terminal 8 over the next three years to prepare for the co-location expected in 2022.

Resubmitted an application to the DOT seeking approval of its joint business agreement with LATAM Airlines Group.

Quarterly Dividend

American declared a dividend of $0.10 per share to be paid on May 22, to stockholders of record as of May 8.

Guidance and Investor Update

American expects its second-quarter 2019 TRASM to be up 1% to 3% year over year. The company also expects its second-quarter 2019 pre-tax margin excluding net special items to be between 7% and 9%2. Based on today’s guidance, American now expects its 2019 diluted earnings per share excluding net special items to be between $4.00 and $6.002.

For additional financial forecasting detail, please refer to the company’s investor update, filed with this release with the SEC on Form 8-K. This filing will be available at aa.com/investorrelations.

Conference Call / Webcast Details

The company will conduct a live audio webcast of its earnings call today at 7:30 a.m. CT, which will be available to the public on a listen-only basis at aa.com/investorrelations. An archive of the webcast will be available on the website through May 26.