AeroCentury Corp. (NYSE:ACY), an independent aircraft leasing company, today reported third quarter 2017 earnings of $385,000, or $0.27 per share, compared to $356,000, or $0.25 per share, in the second quarter of 2017 and compared to $530,000, or $0.34 per share, in the third quarter of 2016.

In the first nine months of 2017, net income grew 10% to approximately $1.4 million, or $0.95 per share, from approximately $1.3 million, or $0.81 per share in the first nine months of 2016.

AeroCentury Corp. announced on October 26th the signing of a merger agreement to acquire JetFleet Holding Corp. (JHC), the parent of JetFleet Management Corp., which has managed the Company’s operations and aircraft portfolio since the Company’s founding in 1997. Under the Merger Agreement, JHC shareholders are to receive $3.5 million in cash and 129,286 shares of the Company's Common Stock, subject to various adjustments at closing, in return for all the outstanding capital stock of JHC. The closing of the acquisition is expected to occur in the first quarter of 2018.

Third Quarter 2017 Highlights

• Acquisition of a mid-life regional jet aircraft, contributing to 6% YTD growth in operating lease portfolio

• Operating lease revenue of $7.6 million, a 25% increase from the year-ago quarter

• Operating margin1 and net margin1 of 8% and 5%, respectively

• Increased EBITDA2 of $6.0 million compared to both the preceding quarter and the year-ago quarter

• Book value per share of $29.19 quarter-end

• 93% portfolio utilization

• Revolving credit facility increased from $150 million to $170 million

• $28.8 million of available liquidity under revolving credit facility at quarter-end

“We are continuing to modernize our portfolio of mid-life leased aircraft, acquiring one Embraer 175 aircraft in the third quarter of 2017 and two Embraer 175 aircraft in the second quarter,” said Michael Magnusson, Chief Executive Officer. “We now have 6 Embraer jet aircraft, 10 Bombardier jet aircraft, and 16 turboprops, and we are in the process of selling 2 Fokker 100 jet aircraft.

Our portfolio of aircraft held for lease now has a weighted average aircraft age of approximately 11 years, and an average remaining lease term of 60 months.”

“We believe the acquisition of JHC marks a significant milestone in our growth by eliminating the third-party management structure, thereby improving visibility into our performance,” Magnusson said. “In addition, we believe the acquisition will facilitate access to capital sources to fuel our growth and will be accretive to earnings.”

Third Quarter 2017 Comparative Data (at or for the periods ended September 30, 2017, June 30, 2017, and September 30, 2016):

• Average portfolio utilization was 93% during both the third quarters of 2017 and 2016, as well as the second quarter of 2017.

• Total revenue increased 3% to $8.3 million for the third quarter of 2017, compared to $8.1 million in the preceding quarter, and grew 12% from $7.4 million a year ago.

Operating lease revenues increased 7% to $7.6 million in the third quarter of 2017 from $7.1 million in the preceding quarter and increased 25% from $6.1 million in the year-ago quarter, reflecting portfolio growth.

Operating lease revenues accounted for 91% of total revenues in the third quarter of 2017, compared to 88% in the second quarter of 2017 and 82% in the year-ago quarter.

During the third quarter of 2017, the Company had minimal gains from disposal of assets or sales-type finance leases, compared to a loss of $148,000 on disposition of assets in the second quarter of 2017 and a $1.2 million gain from sales-type finance leases for two turboprop aircraft in the year-ago quarter.

• Total expenses increased 1% to $7.6 million from $7.5 million in the preceding quarter and increased 15% from $6.6 million in the year-ago quarter, primarily due to higher depreciation, interest expense and management fees from the growth of the portfolio. These increases were partially offset by lower maintenance costs. Second and third quarter 2017 results also included impairment charges of $0.5 million and $0.1 million, respectively.

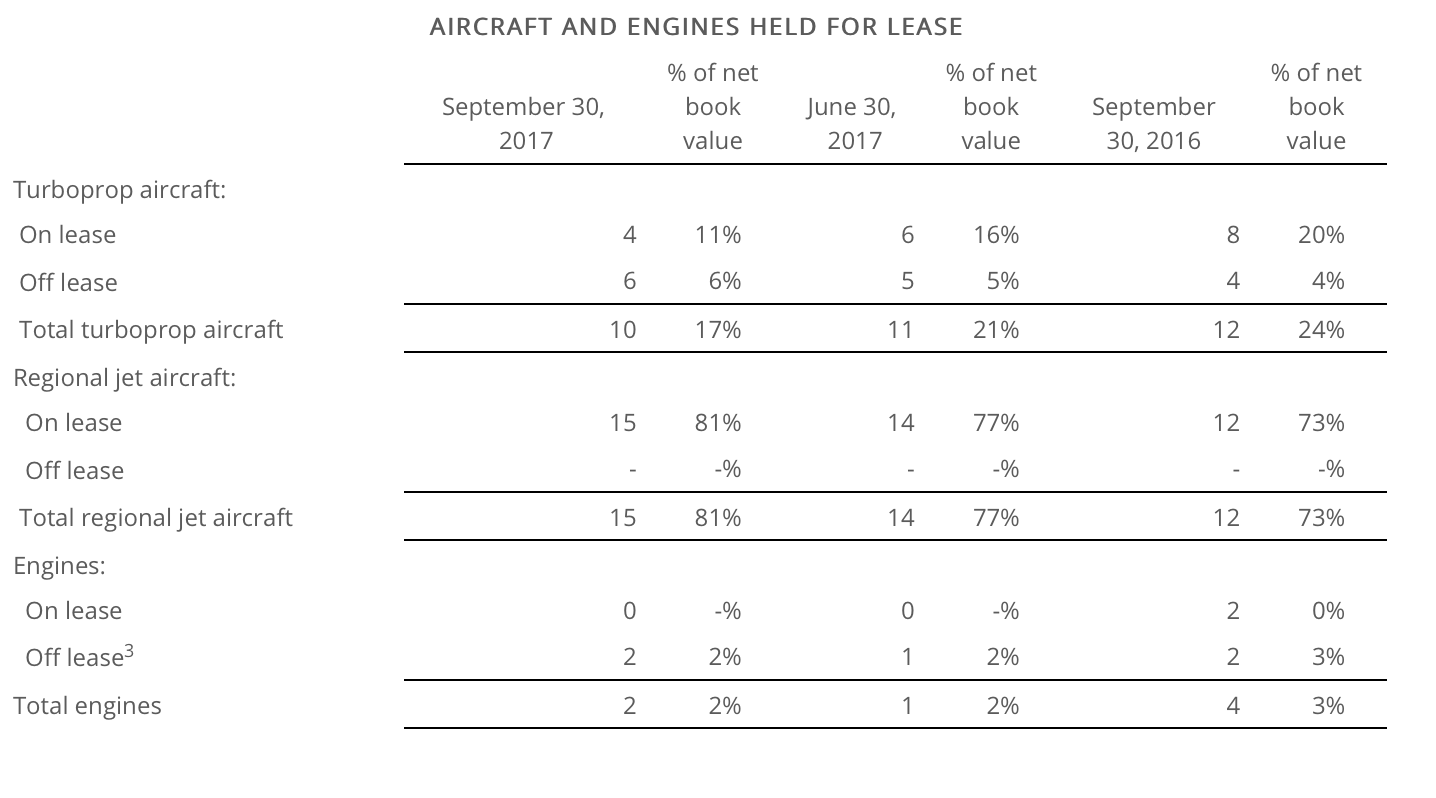

AeroCentury's portfolio currently consists of twenty-five aircraft and two engines that are held for lease and nine aircraft that are held under sales-type or direct finance leases. The Company also has three turboprop aircraft that are held for sale, two of which are being sold in parts.

The Company's portfolio consists of twelve different aircraft types. The current customer base comprises eleven airlines operating in ten countries.

The following table shows the status of the Company's portfolio of aircraft and engines held for lease as of September 30, 2017, June 30, 2017, and September 30, 2016.