AeroCentury Corp. (NYSE American:ACY), an aircraft leasing company, today reported second quarter 2017 earnings grew 19% to $356,000, or $0.25 per diluted share, compared to $299,000, or $0.19 per share in the second quarter of 2016, and compared to $642,000, or $0.41 per share in the first quarter of 2017.

In the first six months of 2017, net income grew 36% to $997,000, or $0.67 per share, from $732,000, or $0.47 per share in the first six months of 2016.

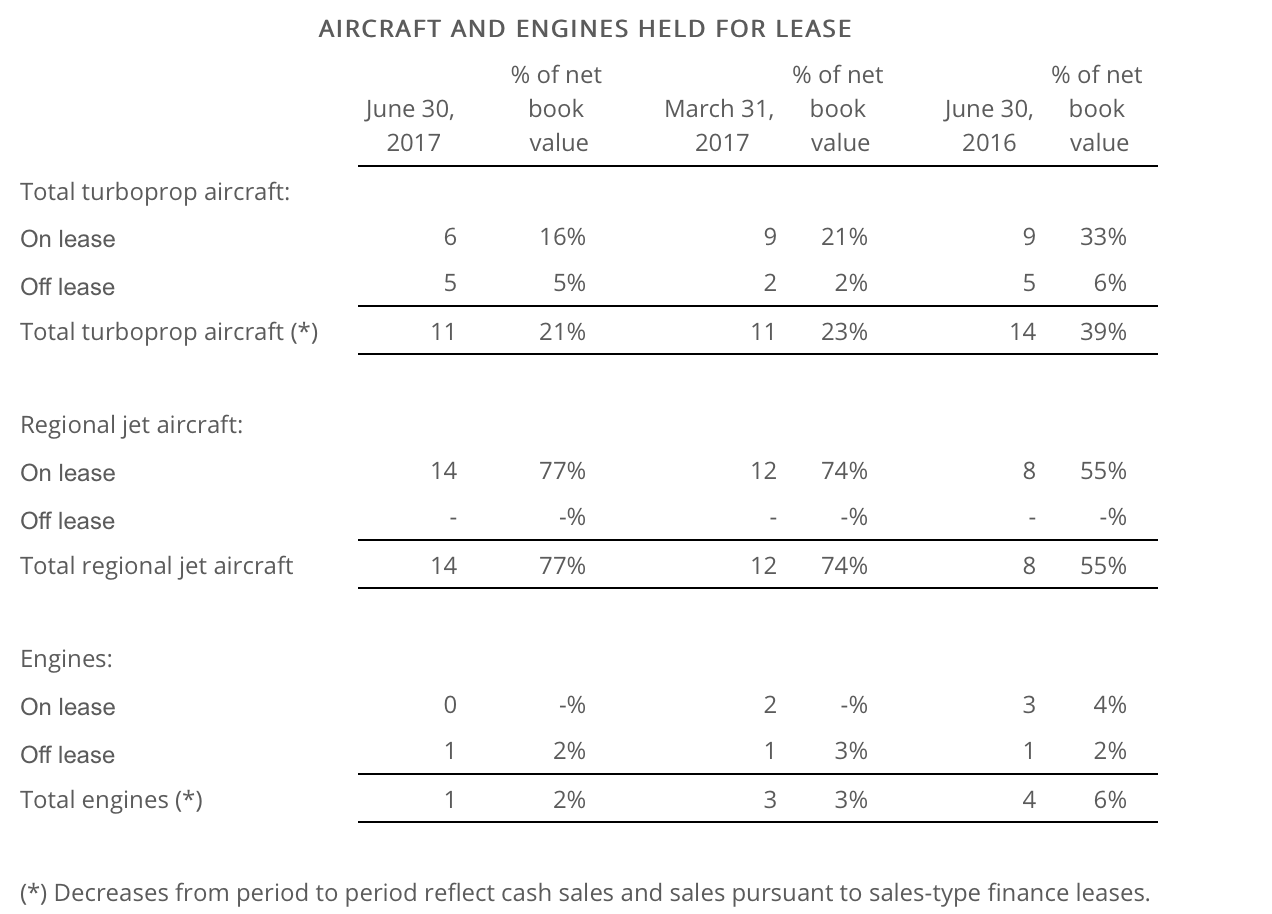

“We have continued to grow our portfolio of mid-life leased aircraft, acquiring two Embraer 175 aircraft in the second quarter of 2017 and a third Embraer 175 aircraft in July. All three aircraft are on long-term leases to Republic Airline which is operating them for American Airlines in the United States,” said Michael G. Magnusson, Chief Executive Officer. “These recent acquisitions, combined with our purchases of Embraer 145 aircraft earlier this year, bring our total number of Embraer aircraft to six, further diversifying our portfolio into this workhorse regional aircraft brand. We now have eleven regional aircraft types and the weighted average aircraft age of our portfolio of aircraft held for lease is approximately eleven years. In addition and consistent with our decision to de-emphasize engine leasing, we sold two spare engines during the second quarter.”

In July 2017, the Company expanded its credit facility to $170 million from $150 million and it may be expanded, subject to certain terms and conditions, to $180 million.

Operating lease revenue in the second quarter of 2017 increased 44% to $7.1 million, compared to $4.9 million in the second quarter of 2016, and was down slightly from $7.3 million in the preceding quarter.

Primarily as a result of aircraft acquisitions during the last twelve months, operating lease revenues for the six months ended June 30, 2017 increased 31% to $14.4 million from $11.0 million a year ago, and the lease portfolio grew 52% to $203.1 million at June 30, 2017 compared to $133.4 million a year ago.

Second Quarter 2017 Highlights (at or for the periods ended June 30, 2017, March 31, 2017, and June 30, 2016):

- Average portfolio utilization, as a percentage of net book value of assets held for lease, was 94% during the second quarter of 2017, compared to 96% in the first quarter of 2017, and 91% in the year ago quarter.

- Total revenue increased 2% to $8.1 million for the second quarter of 2017, compared to $8.0 million in the preceding quarter, and grew 11% from $7.3 million a year ago.

- Operating lease revenues were down slightly to $7.1 million in the second quarter of 2017 from $7.3 million in the preceding quarter, as a result of assets that were off lease during the second quarter, but increased 44% from $4.9 million in the year-ago quarter, reflecting portfolio growth since June 30, 2016.

- During June 2017, the Company recorded a loss of $148,000 on disposition of other assets, primarily driven by a loss on the sale of two spare engines that was partially offset by gains from the sale of spare aircraft parts.

- In the second quarter of 2017, the Company had no gains or loss on sales-type finance leases, compared to gains of $297,000 in the first quarter and $42,000 in the second quarter a year ago.

- Total expenses increased 9% to $7.5 million from $6.9 million in the preceding quarter, primarily due to a second quarter impairment provision of $454,000 on one aircraft and higher maintenance and interest expense. Total expenses in the second quarter of 2017 increased 10% from $6.8 million in the year ago quarter, primarily due to higher depreciation, interest and management fees, reflecting growth in the portfolio, which were partially offset by lower maintenance costs.

- Operating margin and net margin for the June 2017 quarter were 7% and 4%, respectively, compared to 13% and 8%, respectively, for the preceding quarter, and 6% and 4%, respectively, for the year-ago quarter.

EBITDA was $5.2 million for the quarter ended June 30, 2017, compared to $5.6 million for the preceding quarter and $3.5 million in the year-ago quarter.

Book value per share increased to $28.92 at June 30, 2017, compared to $28.66 per share at March 31, 2017, and $26.81 per share at June 30, 2016. - Liquidity available from the revolving credit facility was $16.7 million at June 30, 2017, down from $35.7 million at March 31, 2017, and down from $71.2 million a year ago, reflecting the investments in aircraft made since June 30, 2016.

AeroCentury's portfolio currently consists of nine aircraft that are held under sales-type finance leases and twenty-six aircraft and one engine that are held for lease. The Company also has two turboprop aircraft that are held for sale, one of which is being sold in parts.

The Company's portfolio consists of twelve different aircraft types. The current customer base comprises twelve airlines operating in ten countries.

The following table shows the status of the Company's portfolio of aircraft and engines held for lease as of June 30, 2017, March 31, 2017, and June 30, 2016.