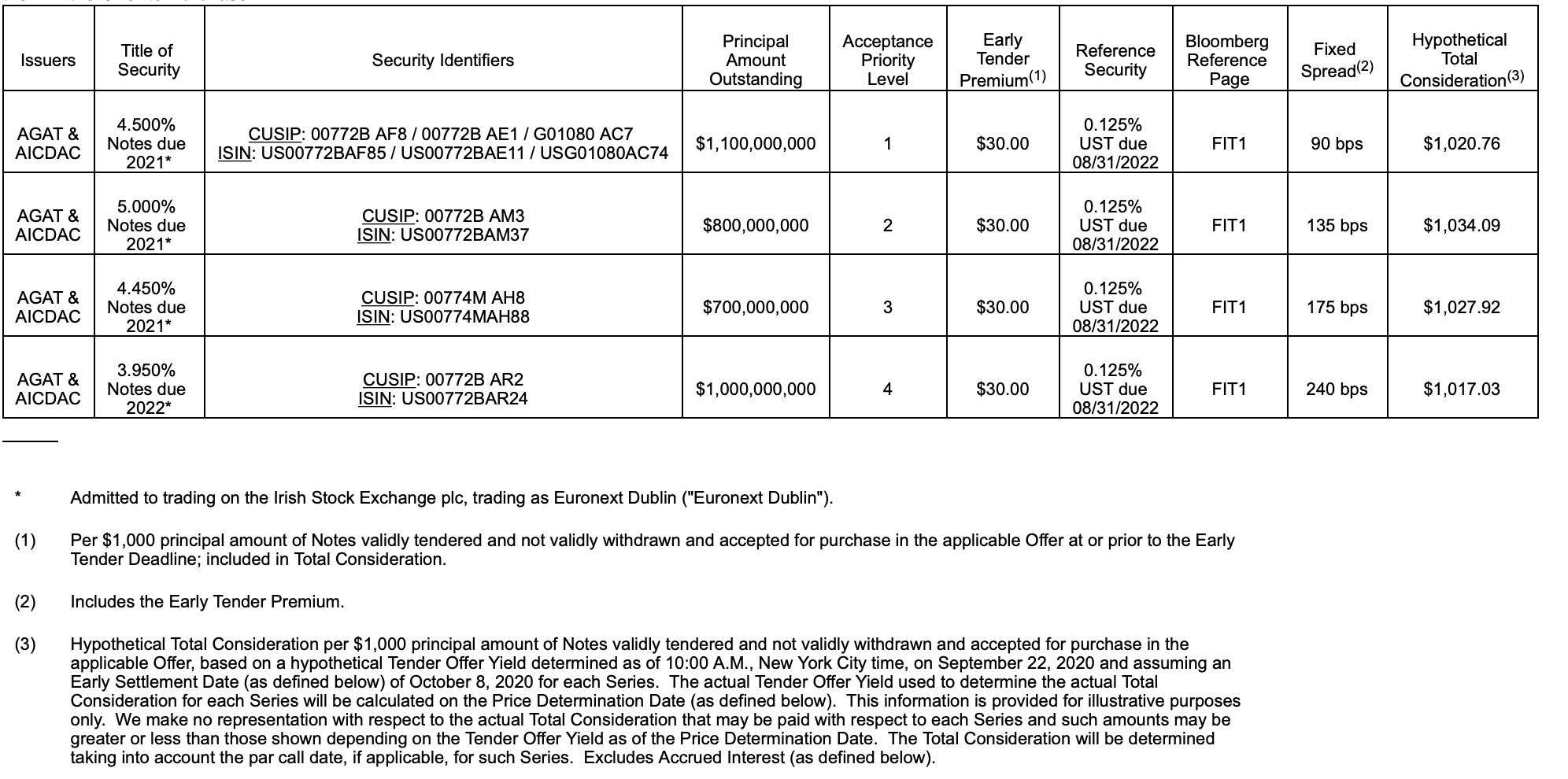

AerCap Holdings N.V. ("AerCap" or the "Company") (NYSE: AER) announced today that AerCap Global Aviation Trust ("AGAT," "we," "us" and "our"), a Delaware statutory trust and wholly-owned subsidiary of the Company, for its own account and on behalf of AerCap Ireland Capital Designated Activity Company ("AICDAC"), offers to purchase for cash the notes listed in the table below (the "Notes") (i) in accordance with, and in the order of, the corresponding Acceptance Priority Levels and (ii) subject to the Maximum Tender Cap (as defined below) and possible pro rata allocation, upon the terms and subject to the conditions set forth in the Offer to Purchase (as defined below), including the Financing Condition (as defined below). The offers to purchase with respect to each series of Notes are referred to herein as the "Offers" and each, an "Offer." Each Offer is made upon the terms and subject to the conditions set forth in the offer to purchase, dated September 23, 2020 (as may be amended or supplemented from time to time, the "Offer to Purchase"), and the related Letter of Transmittal (the "Letter of Transmittal" and, together with the Offer to Purchase, the "Tender Offer Documents"). Capitalized terms used but not defined in this press release have the meanings given to them in the Offer to Purchase.

All documentation relating to the Offers, including the Offer to Purchase and the Letter of Transmittal, together with any updates, are available from the Information Agent and the Tender Agent, as set forth below. The Tender Offer Documents can also be accessed at the following website: http://www.gbsc-usa.com/aercap/. The Tender Offer Documents set forth a complete description of the terms and conditions of the Offers. Holders of the Notes ("Holders") are urged to read the Tender Offer Documents carefully before making any decision with respect to the Offers.

Purpose of the Offers

The primary purpose of the Offers is to acquire the maximum principal amount of Notes for which the aggregate purchase price (including principal and premium, but excluding Accrued Interest) for the Notes does not exceed $500,000,000 (the "Maximum Tender Cap"), subject to the satisfaction or waiver by us of the conditions set forth below and as further described in the Offer to Purchase. Notes that are accepted in the Offers will be purchased, retired and cancelled and will no longer remain outstanding obligations of AerCap or any of its subsidiaries. Such Notes will also be delisted from Euronext Dublin.

Details of the Offers

The Offers will expire at 11:59 p.m., New York City time, on October 21, 2020 (as the same may be extended with respect to any Offer, the "Expiration Date"). Holders must validly tender and not validly withdraw their Notes at or prior to 5:00 p.m., New York City time, on October 6, 2020 (as the same may be extended with respect to any Offer, the "Early Tender Deadline"), to be eligible to receive the applicable Total Consideration and Holders who validly tender their Notes after the Early Tender Deadline and at or prior to the Expiration Date will be eligible to receive only the applicable Purchase Price, which is equal to the applicable Total Consideration less the applicable Early Tender Premium, in each case as fully described in the Offer to Purchase. Tendered Notes may be withdrawn at any time at or prior to 5:00 p.m., New York City time, on October 6, 2020 (as the same may be extended with respect to any Offer, the "Withdrawal Deadline"), but not thereafter, except as required by applicable law as described in the Offer to Purchase. None of the Offers is conditioned upon consummation of any of the other Offers, and each Offer otherwise operates independently from the other Offers. None of the Offers is conditioned on any minimum amount of Notes being tendered.

The applicable Total Consideration for each $1,000 in principal amount of Notes validly tendered and not validly withdrawn before the Early Tender Deadline and accepted for purchase pursuant to the Offers will be determined by reference to a fixed spread specified for each Series of Notes over the yield based on the bid price of the applicable Reference Security specified in the table above for such Series, as fully described in the Offer to Purchase. The consideration will be calculated by the Dealer Managers (as defined below) at 10:00 A.M., New York City time, on October 7, 2020 (as the same may be extended with respect to any Offer, the "Price Determination Date"). The applicable Early Tender Premium for each Series of Notes is set forth in the table above. The Purchase Price for the Notes accepted for purchase pursuant to the Offers will be calculated by taking the applicable Total Consideration for such Series of Notes and subtracting from it the applicable Early Tender Premium for such Series of Notes. In addition to the applicable Total Consideration or applicable Purchase Price, as the case may be, accrued and unpaid interest from the last interest payment date up to, but not including, the applicable Settlement Date will be paid in cash on all validly tendered Notes accepted for purchase in the Offers (the "Accrued Interest").

We reserve the right, but are under no obligation, at any point after the Early Tender Deadline and prior to the Expiration Date, to accept for purchase Notes that have been validly tendered and not validly withdrawn at or prior to the Early Tender Deadline on a date determined at our option (such date, if any, the "Early Settlement Date"). The Total Consideration, plus Accrued Interest, for Notes that are validly tendered and not validly withdrawn at or prior to the Early Tender Deadline and accepted for purchase will be paid by us in same-day funds on such Early Settlement Date, if any. We currently expect the Early Settlement Date, if any, to occur on October 8, 2020. The Purchase Price, plus Accrued Interest, for Notes that are validly tendered and not validly withdrawn after the Early Tender Deadline and at or prior to the Expiration Date and accepted for purchase will be paid by us in same-day funds promptly following the Expiration Date (the "Final Settlement Date"). We currently expect the Final Settlement Date to occur promptly following the Expiration Date, on October 23, 2020.

Our obligation to accept for purchase, and to pay for, Notes that are validly tendered and not validly withdrawn pursuant to each Offer, up to the Maximum Tender Cap, is conditioned on the satisfaction or waiver by us of a number of conditions set forth in the Offer to Purchase, including our receipt prior to the Expiration Date (or Early Settlement Date, if we elect to have an early settlement) of gross proceeds of at least $500,000,000 from our contemporaneous offering of one or more series of notes upon the terms and subject to the conditions contained in the prospectus related to such offering, on terms satisfactory to us in our sole discretion (the "Financing Condition"), in each case unless waived by us as provided in the Offer to Purchase.

The amounts of each Series of Notes that are accepted for purchase in the Offer will be determined in accordance with the priorities identified in the column "Acceptance Priority Level" in the table above. Subject to the Maximum Tender Cap, all Notes validly tendered and not validly withdrawn at or prior to the Early Tender Deadline having a higher Acceptance Priority Level will be accepted for purchase before any validly tendered and not validly withdrawn Notes having a lower Acceptance Priority Level, and all Notes validly tendered after the Early Tender Deadline and at or prior to the Expiration Date having a higher Acceptance Priority Level will be accepted for purchase before any Notes tendered after the Early Tender Deadline and at or prior to the Expiration Date having a lower Acceptance Priority Level. However, any Notes validly tendered and not validly withdrawn at or before the Early Tender Deadline will be accepted for purchase in priority to Notes validly tendered after the Early Tender Deadline and at or prior to the Expiration Date even if the Notes tendered after the Early Tender Deadline and at or prior to the Expiration Date have a higher Acceptance Priority Level than the Notes validly tendered and not validly withdrawn at or before the Early Tender Deadline. Notes of the Series in the last Acceptance Priority Level accepted for purchase in accordance with the terms and conditions of the Offers may be subject to proration such that we will only accept for purchase Notes with an aggregate purchase price up to the Maximum Tender Cap.

We expressly reserve the right, in our sole discretion, to amend, extend or, upon failure of any condition described in the Offer to Purchase to be satisfied or waived (including the Financing Condition), to terminate any of the Offers, including the right to amend or eliminate the Maximum Tender Cap, at any time at or prior to the Expiration Date.

Barclays Capital Inc., Deutsche Bank Securities Inc. and Morgan Stanley & Co. LLC are serving as the Lead Dealer Managers, and BofA Securities, Inc., HSBC Securities (USA) Inc., RBC Capital Markets, LLC and SG Americas Securities, LLC are serving as Co-Dealer Managers, in connection with the Offers (collectively, the "Dealer Managers"). Questions regarding terms and conditions of the Offers should be directed to Barclays Capital Inc. by calling toll free at 800-438-3242 or collect at 212-528-7581, to Deutsche Bank Securities Inc. by calling toll free at 866-627-0391 or collect at 212-250-2955 or to Morgan Stanley & Co. LLC by calling toll free at 800-624-1808 or collect at 212-761-1057.

Global Bondholder Services Corporation has been appointed as information agent (the "Information Agent") and tender agent (the "Tender Agent") in connection with the Offers. Questions or requests for assistance in connection with the Offers or the delivery of tender instructions, or for additional copies of the Tender Offer Documents, may be directed to Global Bondholder Services Corporation by calling collect at 212-430-3774 (for banks and brokers) or toll free at 866-807-2200 (for all others) or via e-mail at contact@gbsc-usa.com. You may also contact your broker, dealer, commercial bank, trust company or other nominee for assistance concerning the Offers. The Tender Offer Documents can also be accessed at the following website: http://www.gbsc-usa.com/aercap/.

None of AGAT, the Company, the Dealer Managers, Global Bondholder Services Corporation, the trustee under the indenture governing the Notes or any of their respective affiliates is making any recommendation as to whether Holders should tender any Notes in response to the Offers. Holders must make their own decision as to whether to tender any of their Notes and, if so, the principal amounts of Notes to tender.

This press release is for informational purposes only and is not an offer to purchase or sell or a solicitation of an offer to purchase or sell with respect to any securities. Neither this press release nor the Offer to Purchase, or the electronic transmission thereof, constitutes an offer to purchase or sell or a solicitation of an offer to purchase or sell with respect to any securities, as applicable, in any jurisdiction in which, or to or from any person to or from whom, it is unlawful to make such offer or solicitation under applicable securities laws or otherwise. The distribution of this press release in certain jurisdictions may be restricted by law. In those jurisdictions where the securities, blue sky or other laws require the Offers to be made by a licensed broker or dealer and the Dealer Managers or any of their respective affiliates is such a licensed broker or dealer in any such jurisdiction, the Offers shall be deemed to be made by the Dealer Managers or such affiliate, as the case may be, on behalf of AGAT in such jurisdiction.