- Global passenger traffic was down an estimated 67% this year versus 2019 and was reduced to 1999 levels

- Travel restrictions to curb COVID-19 forced airlines to cut flights by 49%, from 33.2 million in 2019 to 16.8 million during 2020

- Only 3.8 million flights flown internationally in 2020; 77% of all flights were domestic

- 30% of global commercial fleet remains in storage

Cirium has today revealed a new 2020 review of aviation and air travel. The review includes key data insights from the past year and expert commentary from Cirium CEO, Jeremy Bowen, Henry Harteveldt, Dr. Mario Hardy and more. (Graphic: Business Wire)

Global aviation data firm Cirium today released its new Airline Insights Review 2020 which reveals the shocking impact on aviation of worldwide travel restrictions to curb COVID-19.

“Airlines will have a way before returning to 2019 levels particularly as international travel is significantly down and showing only slow signs of recovery, mainly China and Southeast Asia”Tweet this

The report shows that the pandemic and its consequences wiped out 21 years of global passenger traffic growth in a matter of months, reducing traffic this year to levels last seen in 1999. In comparison to last year, passenger traffic is estimated to be down 67% in 2020.

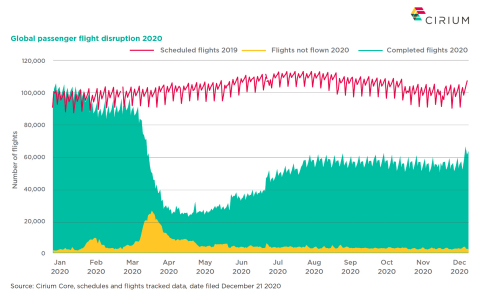

At the peak of the disruption in April, scheduled passenger flights dropped significantly to just 13,600 globally on April 25, compared to the year’s busiest day on January 3 when Cirium tracked over 95,000 scheduled passenger flights globally. This marks an extraordinary 86% reduction in flights.

From January to December airlines operated 49% fewer flights in 2020 compared to 2019 – down from 33.2 million flights to just 16.8 million (to December 20).

Domestic travel was down 40% this year, from 21.5 million flights in 2019, while international flights suffered an even more precipitous drop as they were 68% below the 11.7 million flights tracked the year before.

Jeremy Bowen, CEO of Cirium, said: “This severe setback shows the true extent of the challenge faced by the struggling aviation sector as it has sought to reset itself in the new post COVID-19 era.”

“Whereas this time last year we were celebrating the on-time performance of global carriers, this year is dramatically different. Most global airlines were largely on time in 2020; it’s just a shame that the traveling public, airlines and aviation firms worldwide didn’t benefit.

“The factors which usually cause delay, such as congested airspace, taxiways and late connecting passengers simply did not exist in 2020.”

The Cirium Airline Insights Review 2020 replaces Cirium’s annual On-Time Performance Review which for more than a decade has identified the world’s best performing airlines and airports for on-time flight operations.

NEW AIRLINE INSIGHTS REVIEW: FLIGHTS FLOWN DRAMATICALLY DOWN

Global passenger traffic figures reveal a plunge of over two thirds (67%) versus the previous year, with Asia-Pacific continuing to handle over a third of world passenger traffic.

The majority of the scheduled passenger flights flown this year have been domestic – totaling 13 million (77%) with a mere 3.8 million (23%) flying internationally, due to closed borders and limited business travel.

Cirium data analysis recorded Southwest Airlines operating the most flights globally (and in North America), with 854,800 flights in total. Meanwhile, China Southern Airlines (487,700 flights) topped the tables in the Asia-Pacific, Ryanair in Europe (205,000 flights), Azul in Latin America (134,000 flights) and Qatar Airways (82,400 flights) in the Middle East and Africa.

On the ground, Atlanta was the world’s busiest airport, handling over 245,000 arriving flights during 2020, while the world’s busiest air route in both directions was within South Korea, between Seoul and the island of Jeju with 70,700 flights operated.

Forward planning for airlines has dramatically contracted from six- to 12-months for flight scheduling to just six- to eight-weeks – forcing carriers to be nimbler and adapt with greater speed to the rapidly changing rules and travel restrictions around the world.

FLEETS IN STORAGE (BUT NOT THE A320)

As airlines have been forced to drastically reduce the number of aircraft still in service, those still flying are operating significantly fewer hours.

For example, narrowbody aircraft operated just six to seven hours a day in Q3 2020 compared to nine to 10 hours a day in the same period last year.

While up to 30% of the global passenger fleet remains in storage there are signs of recovery on the horizon, with only 10% of short-haul Airbus A320neo aircraft currently in storage showing narrowbody aircraft leading the recovery and domestic and short-haul travel returning first.

With domestic and short-haul services ruling the day, the world’s most used aircraft type was the Airbus A320 with Cirium tracking 5.49 million flights throughout 2020.

SEVEN TRENDS IDENTIFIED BY CIRIUM

“Airlines will have a way before returning to 2019 levels particularly as international travel is significantly down and showing only slow signs of recovery, mainly China and Southeast Asia,” Jeremy Bowen added.

“But Cirium is confident aviation will weather this difficult and terrible year and emerge in better shape – with younger more fuel-efficient aircraft and right-sized fleets – to gradually navigate their way to recovery in the years ahead.”

The seven key trends outlined by The Cirium Airline Insights Review 2020 for next year include:

- The consolidation of airlines, particularly in Asia-Pacific where more domestic competitors will merge or be acquired.

- New-generation aircraft like the A320neo and the return of the 737 Max, will provide reduced operating costs.

- Surplus aircraft will be retired and the Boeing 747 and the Airbus A380 are projected to support the rising demand in the denser leisure markets.

- In Q4 we saw a 78% plunge in bookings compared to the same period last year – this will naturally change the way the industry forecasts demand, we are seeing on-line search and sentiment becoming the primary indicators to calculate demand.

- Airlines will need to deploy more dynamic scheduling with the increased volatility of flight scheduling, as the booking window has fallen from six- to 12-months to just six- to eight-weeks.

- The implementation of AI technology will accelerate to automate the traveler experience and real-time proactive information will become more critical.

- Aircraft leasing will push past 50% becoming the major manner in which aircraft are financed.

To read the full Cirium Airline Insights Review 2020 – click here.

Bowen thanked the OTP board members comprised of Henry Harteveldt at Atmosphere Research group and Dr. Mario Hardy at Pacific Asia Travel Association (PATA) for their insights and contributions to the Airline Insight Review 2020.