GROUP EARNINGS

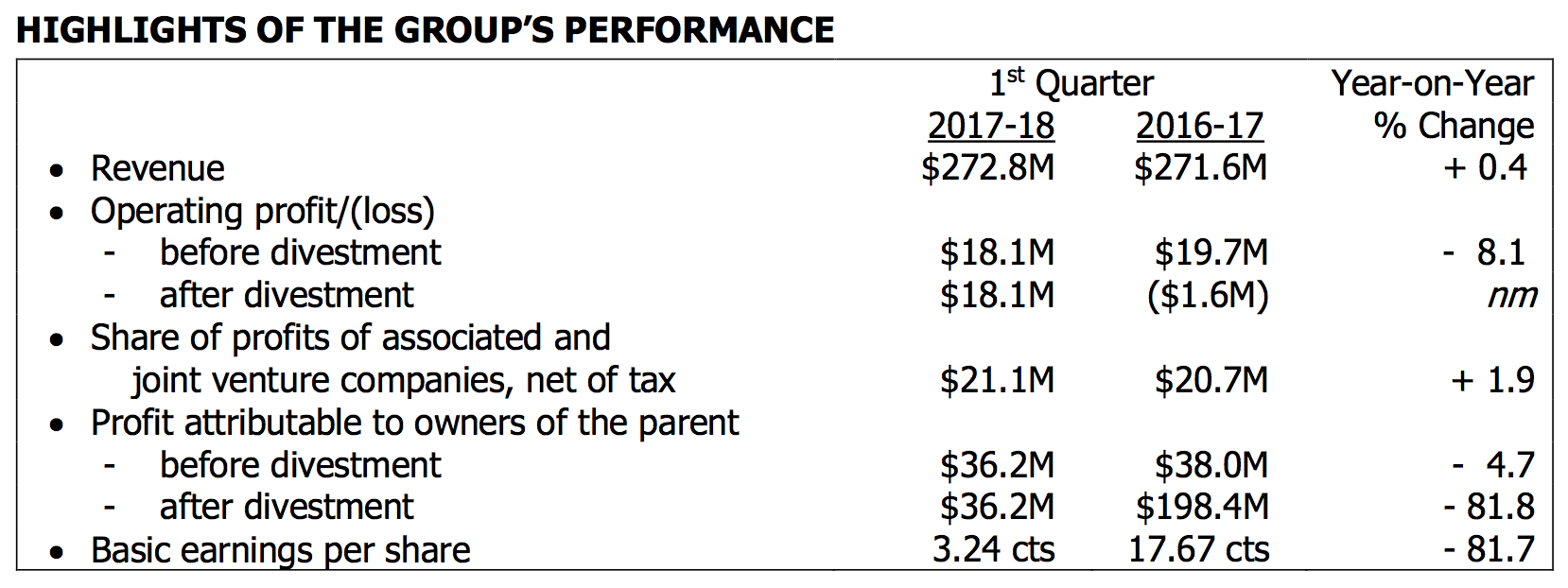

SIAEC Group posted a profit attributable to owners of the parent of $36.2 million for the quarter ended 30 June 2017, compared to a profit of $198.4 million for the same quarter last year. The profit in the same quarter last year was higher as it included a gain from the divestment of the Group’s 10% stake in Hong Kong Aero Engine Services Ltd (“HAESL”) to Rolls-Royce Overseas Holdings Limited (“RROH”) and Hong Kong Aircraft Engineering Company Limited (“HAECO”). Excluding the impact of the divestment in the quarter ended 30 June 2016, profit for the current quarter of $36.2 million was $1.8 million or 4.7% lower.

Revenue at $272.8 million was comparable to the same quarter last year.

Expenditure decreased by $18.5 million or 6.8% to $254.7 million, mainly due to a provision made in the same quarter last year for the estimated increase in the profit-linked component of staff remuneration arising from the gain on divestment, based on profitability-related key performance indicators. Operating profit for the current quarter amounted to $18.1 million, $19.7 million higher compared to the operating loss of $1.6 million last year.

Share of profits of associated and joint venture companies increased $0.4 million or 1.9% to $21.1 million. Contributions from Eagle Services Asia Private Limited and other associated companies increased, offset by lower contributions from Singapore Aero Engine Services Pte Ltd arising from the lower work content of engines shipped.

Basic earnings per share was 3.24 cents for the quarter ended 30 June 2017.

GROUP FINANCIAL POSITION

As at 30 June 2017, equity attributable to owners of the parent increased $27.1 million or 1.7% to $1,581.1 million, mainly due to profits earned for the quarter. Total assets amounted to $1,959.1 million, an increase of $40.8 million or 2.1%. The Group’s cash balance was $628.7 million as at 30 June 2017.

Net asset value per share as at 30 June 2017 was 141.3 cents.

OUTLOOK

The operating environment for the maintenance, repair and overhaul (MRO) industry remains challenging. Notwithstanding this, the Group has continued to pursue expansion opportunities for sustainable long-term growth.

During the quarter, we announced that we reached an in-principle agreement with GE Aviation to form an engine overhaul joint venture in Singapore. This marks our third engine overhaul facility with the world’s leading engine manufacturers. This venture will further strengthen the Group’s capabilities to provide MRO services to airlines' new-generation fleets on a wide range of engine models. We have also expanded our geographical network with the incorporation of a wholly-owned subsidiary in Osaka to provide line maintenance services at this key airport in Japan. The foregoing and other recent investments are not expected to be accretive in the near-term.

At the same time, the Company will continue with initiatives to increase productivity, enhance operational efficiencies and manage our costs to remain competitive.