COMMENTARY

Change of financial year

During the year, the Directors resolved to change the Group’s year end from 31 March to 31 December. Consequently, the financial statements cover the nine month period from 1 April 2017 to 31 December.2017. The comparative balances have been presented for the twelve months period from 1 April 2016 to 31 March 2017.

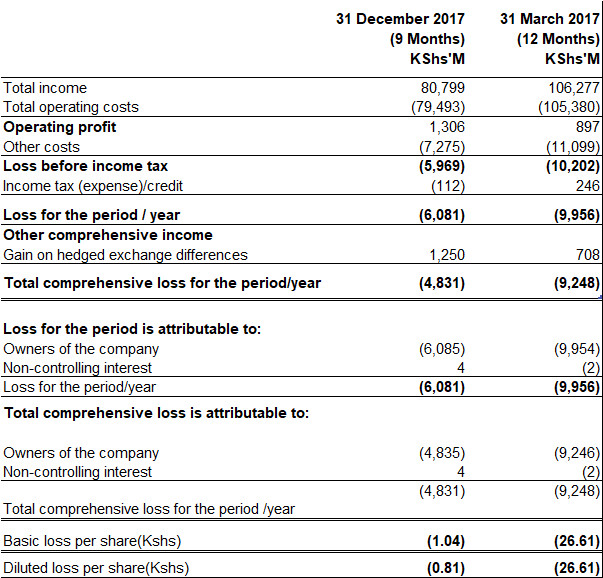

Kenya Airways Plc recorded an improved operating profit of KShs 1,306 million and an improved loss before tax of KShs 5,969 million for the nine month period ended 31 December 2017.

Operating highlights:

Passenger numbers stood at 3.43 million for the 9 month period ended 31 December 2017. The prior year period covering 12 month stood at 4.46 million.

Cabin factor for the 9 month period was 76.2 percent. The prior year 12 month period was 72.3 percent.

Yield per revenue passenger kilometre declined by 6.5% for the 9 month period ended 31 December 2017 driven by market capacity pressure and currency fluctuations.

Financial highlights:

Operating profit for the 9-month period, ended 31 December 2017 was KShs 1,306 million. In the prior year covering 12 months, the operating profit closed at KShs 897 million.

Fleet costs for the 9-month period ended 31 December 2017 was KShs 10,556 million. In the prior year ended 31 March 2017 fleet costs stood at KShs 15,524 million.

Overheads for the 9-month period, ended 31 December 2017 was KShs 15,537 million. In the prior year, ended 31 March 2017 overheads stood at KShs 24,500 million.

Loss before tax for the 9-month period, ended 31 December 2017 was KShs 5.97 billion. In the prior year, ended 31 March 2017 loss before tax closed at KShs 10.2 billion.

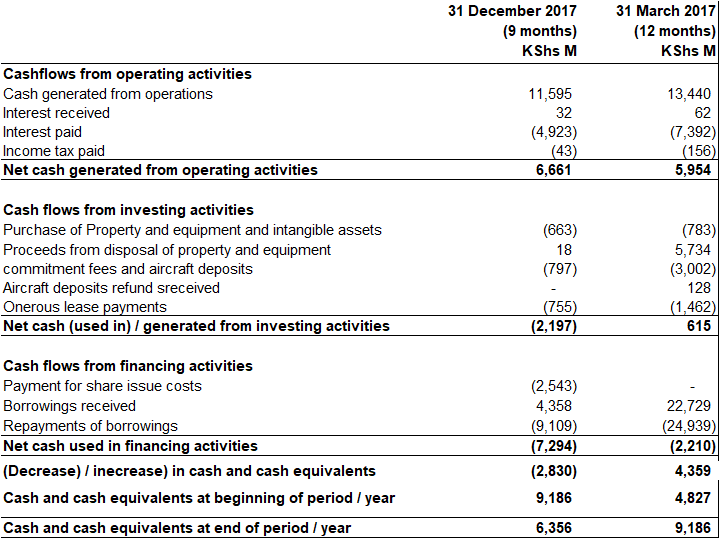

Although reporting an improved performance, the airline operated in a challenging environment. During the period, fuel price continued on an upward trend closing at USD 62 per barrel hence increasing the Group’s operating costs by 9%. The Group’s revenue for the period under review were heavily impacted by the elevated political tension as a result of the prolonged electioneering period which saw reduced transit and terminating passenger through our hub at JKIA.

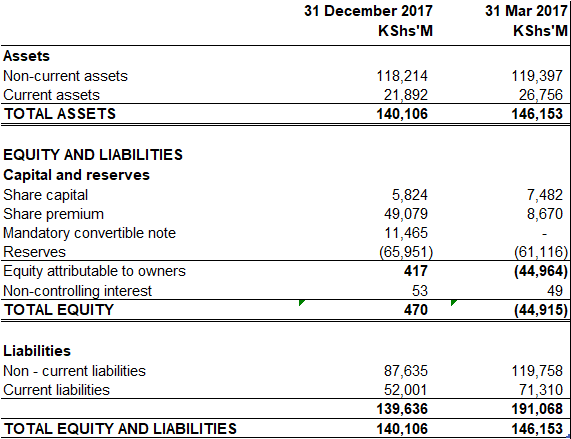

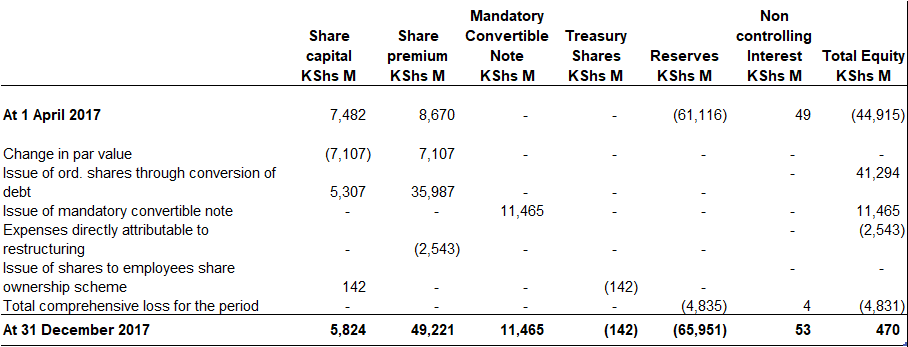

Capital optimisation

In November 2017, the Airline completed the capital optimisation plan involving a solvent and consensual restructuring of the Group’s liabilities by converting short term loans from local banks and Government of Kenya into equity in-order to reduce its leverage position. The Government of Kenya further provided sovereign guarantee to enable aircraft financiers reschedule their payments in order to provide liquidity relief to the Airline.

Outlook

Having concluded the financial restructuring, the Group is now focused on an operational turn around that will provide a stable base for long-term growth through an optimised network that creates more connections through our hub in Nairobi, drive efficiency in-order to reduce overall costs, as well as focus on improved service quality and delivery.

On behalf of the Board of Directors, I take this opportunity to express my sincere appreciation to our customers, the Government of Kenya, shareholders, management, staff, suppliers and other stakeholders for their continued support to Kenya Airways.