October 13th, London: Independent aviation consultancy firm IBA predicts that the aircraft market in the Middle East is set for a succession of deferrals between now and 2036. Speaking to an audience of lessors, lessees, operators, financiers, banks and lawyers at a Conference in Dubai, IBA’s CEO Phil Seymour said that a combination of key factors including overcapacity, low fuel price and local unrest, are all contributing towards carriers deferring.

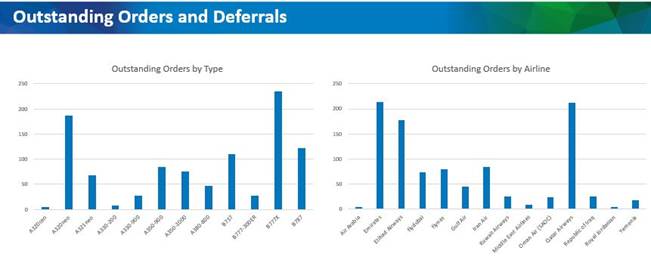

“The current backlog in the region is 996 aircraft, with the main airlines Emirates, Etihad and Qatar all being affected by decreasing yields due to overcapacity” said Seymour.

Fleet data pulled from IBA.iQ in the chart below, shows that Emirates has recently deferred twelve A380s, with IBA forecasting that there is also a possibility of Etihad deferring a number of Dreamliners. This in turn could also extend to A350-900/1000s, as the market segment is broadly similar.

Speaking at the conference, Seymour also commented that whilst Qatar’s recent cancellation of four A350-900s was attributed to supply issues, “many believe that it was a useful reason to ease the overcapacity situation, and that there is a possibility that Qatar will also defer a number of A350-1000s.” Next year, Seymour went on to say, “Qatar will finally start taking on A320neos after stalling over engine problems. Overcapacity will then impact on the Boeing 777X program.”

Yemenia’s orders for the A320neos and A350-900s, says IBA, will be delayed until the situation within the country improves.