International Consolidated Airlines Group (IAG) today (February 23, 2018) presented Group consolidated results for the year to December 31, 2017.

IAG period highlights on results:

Fourth quarter operating profit €585 million before exceptional items (2016: €620 million)

Passenger unit revenue for the quarter up 0.4 per cent, up 2.4 per cent at constant currency

Non-fuel unit costs before exceptional items for the quarter are up 0.5 per cent, up 3.2 per cent at constant currency

Fuel unit costs before exceptional items for the quarter up 1.2 per cent, up 2.2 per cent at constant currency

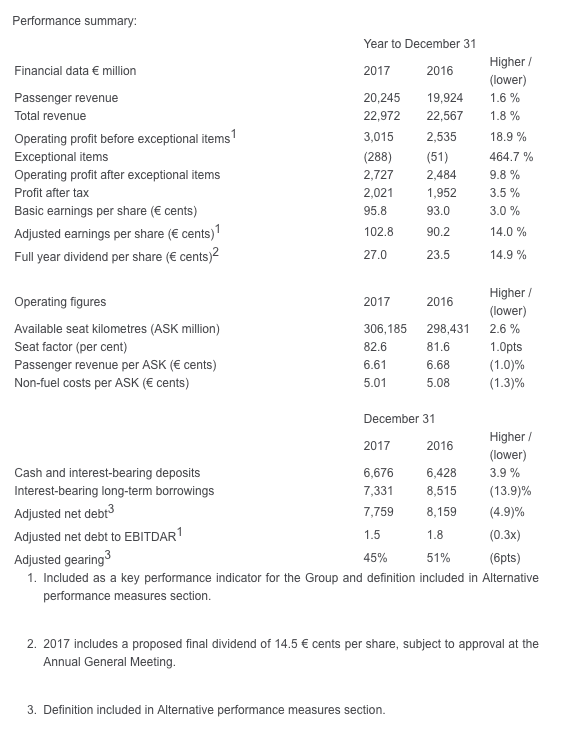

Operating profit before exceptional items for the year to December 31, 2017 of €3,015 million (2016: €2,535 million),

up 18.9 per cent

Passenger unit revenue for the year down 1.0 per cent and up 1.5 per cent at constant currency

Fuel unit costs for the year before exceptional items down 7.8 per cent, down 9.1 per cent at constant currency

Non-fuel unit costs for the year before exceptional items down 1.3 per cent and up 2.7 per cent at constant currency

Cash of €6,676 million at December 31, 2017 was up €248 million on 2016 year end

Adjusted net debt to EBITDAR decreased 0.3 to 1.5 times

Profit after tax before exceptional items €2,243 million up 12.7 per cent, and adjusted earnings per share up 14.0 per cent

Willie Walsh, IAG Chief Executive Officer, said:

“We’re reporting a very good full year performance with an operating profit of €3,015 million before exceptional items, up 18.9 per cent compared to last year.

“Passenger unit revenue improved 1.5 per cent at constant currency and we benefitted from reduced fuel costs for most of 2017 though our fuel bill started to rise in quarter 4.

“All our airlines performed extremely well with their best-ever individual financial results, strong operational performances and commitment to customer service. The turnaround in Vueling, following the challenges of 2016, has been particularly outstanding.

“In quarter 4 we reported an operating profit of €585 million, down from €620 million last year. Our strong performance continued with passenger unit revenue up 2.4 per cent at constant currency. The operating profit was impacted significantly by changes in the employee bonus provision in the quarter compared to the previous year.

“We’re pleased to confirm that the Board is proposing a final dividend of 14.5 euro cents per share. This brings the full year dividend to 27.0 euro cents per share, subject to shareholder approval at our AGM in June. With the dividend and share buyback, we returned more than €1 billion to our shareholders last year.

“Our confidence in IAG’s future remains undaunted and today we’re announcing our intention to undertake a share buyback of €500 million during 2018”.

Trading outlook

At current fuel prices and exchange rates, IAG expects its operating profit for 2018 to show an increase year-on-year. Both passenger unit revenue and non-fuel unit costs are expected to improve at constant currency.