Flybe today presents its consolidated Group results for the six months to 30th September 2017.

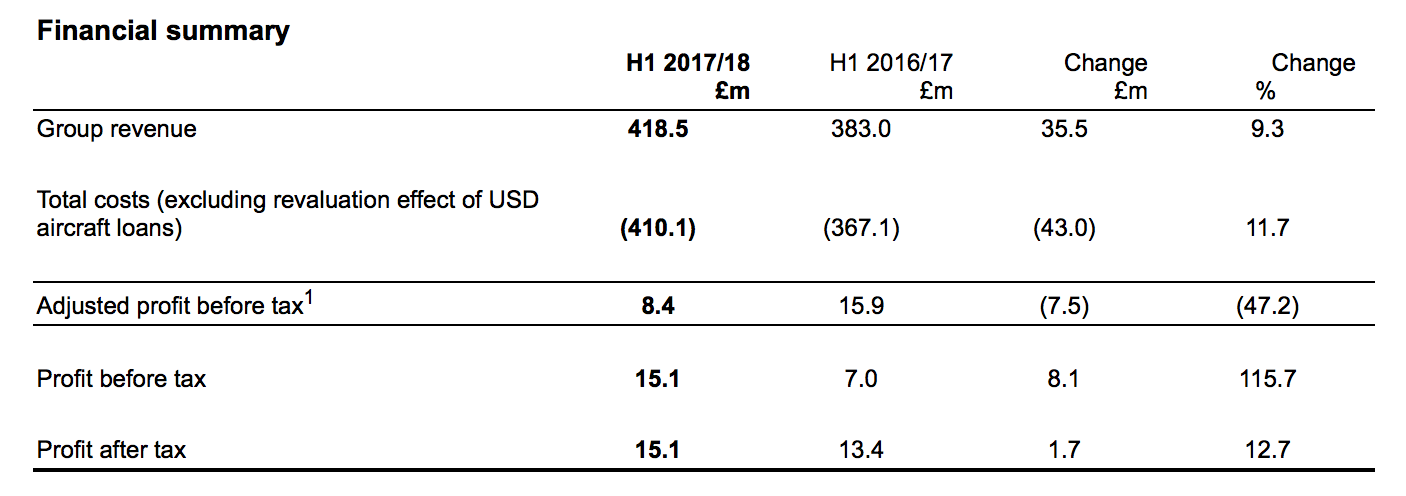

The half-year results are summarised below:

Financial summary

Financial overview - Group

· 9.3% increase in Group revenue to £418.5m (H1 2016/17: £383.0m).

· Adjusted profit before tax1 reduced to £8.4m (H1 2016/17: £15.9m) largely due to the previously announced one-off onerous IT contract provision and the impact of increased aircraft maintenance costs. This adjusted profit before tax is towards the upper end of the range of £5m to £10m announced on 18th October 2017.

· Profit before tax increased to £15.1m (H1 2016/17: £7.0m) reflecting £6.7m of non-cash revaluation gains on USD aircraft loans (H1 2016/17: losses of £8.9m).

· 3.1% increase in EBITDAR2 to £85.8m (H1 2016/17: £83.2m).

· Stable net assets of £151.7m (31st March 2017: £153.5m) with a small seasonal increase in net debt to £67.0m (31st March 2017: £64.0m).

1Adjusted profit before tax is reported profit before tax excluding the revaluation effect of USD aircraft loans (see above).

2EBITDAR defined as operating profit after adding back depreciation, amortisation and aircraft rental charges (see above).

Christine Ourmieres-Widener, Chief Executive Officer, commented:

"We have made good progress in the first half of the year and with our fleet size under control, we are already delivering improvements to passenger yield and load factors. Load factors are expected to continue to strengthen as the fleet reduces and we anticipate that yields will stabilise. While half-year profits are lower than last year, due to the one-off IT contract costs, higher maintenance expenses and the impact of the fall in the value of sterling, I am confident that we are on a clear path to sustainable profitability through the investments and improvements we are making at Flybe. In the second half, we will focus on improving our cost base and reliability performance while preparing the business for the future as we invest in the new digital platform. As the business model changes, I am particularly pleased to have a new senior management team with ever more aviation experience.

I look forward to a positive future and would like to thank all Flybe employees for their ongoing support and commitment."

Flybe UK

· 11.6% increase in total revenue to £406.8m (H1 2016/17: £364.6m).

· 3.0% growth in seat capacity, slowing as we have greater control over the fleet.

· 8.8% increase in passenger volumes to 5.2 million (H1 2016/17: 4.8 million).

· 4.0 percentage points improvement in load factor to 76.0% (H1 2016/17: 72.0%).

· 3.0% growth in passenger yield to £72.73 (H1 2016/17: £70.58).

· 8.8% improvement in revenue per seat to £55.29 (H1 2016/17: £50.80).

· 10.1% increase in cost per seat at constant currency (excluding fuel) due principally to the onerous IT contract provision, higher maintenance costs and lower value of sterling.

· 6.9% increase in cost per seat (including fuel) at constant currency helped by lower fuel costs as a result of hedging gains.

· Profit before tax increased to £13.3m (H1 2016/17: £5.3m).

Flybe Aviation Services (FAS)

· 11.6% increase in FAS revenue to £26.6m (H1 2016/17: £23.8m).

· 9.7% increase in total man-hours, but a 39.3% decrease in chargeable third party man-hours reflecting the focus on internal maintenance and handbacks.

· 5.3% increase in profit before tax to £1.8m (H1 2016/17: £1.7m).

Flybe is building for a sustainable profitable future

As announced at the year end results in June 2017, we have implemented a Sustainable Business Improvement Plan aimed at driving sustainable profit and cash generation. This plan consists of six focus areas underpinned by a strong organisation and safety culture:

· Sales and marketing;

· Network, fleet and revenue optimisation;

· Operational excellence;

· Organisational excellence;

· Technology; and

· Cost improvement.

Our strategy remains on track to reduce our fleet size to an optimum level for the number of identified profitable routes and make the business demand-driven rather than capacity-led. As previously announced, fleet numbers peaked in May 2017 at 85 aircraft, as legacy aircraft orders have been largely fulfilled. We now plan to reduce the fleet size over the next three years to around 70 aircraft in 2019/20 (including the five ATR aircraft fulfilling the SAS White Label contract). We will hand back six end of lease Bombardier Q400 aircraft this financial year, of which four have already been returned (two during H1 and two in October/November). Each handback is benefiting from the experience gained on the prior handbacks.

Capacity will start to fall in the second half as further handbacks take place and there are two main benefits arising from our ability to control our fleet size. Firstly, we are able to focus our resources on fewer, more profitable routes; five loss making routes have already been closed. This delivers improvement in our load factors and helps to maintain yield. Secondly, the greater stability in our route network will give operational efficiencies and better customer service.

Load factors were 76.0% in H1 2017/18, up 4.0 percentage points on H1 last year with the Q2 improvement being even stronger than Q1. Average passenger yield was £72.73, up 3.0% on last H1. As a result, passenger revenue per seat was up 8.8% in the first half, significantly ahead of the capacity growth of 3.0%.

Scotland remains a core part of our network and we are further strengthening our connectivity in Scotland. The new Heathrow routes continue to perform in line or ahead of our expectations, and our turboprop aircraft are now an established part of Heathrow's operations. In addition, we recently embarked on a commercial partnership with Eastern Airways, franchising Eastern's existing routes as Flybe. We have also launched six new partnership (risk-sharing) routes with Eastern, both within Scotland and connecting Scotland to England which also provide links to Flybe connecting flights. This helps to further support Flybe's long-term 'One Stop to the World' model, connecting our passengers through our own network, plus codeshare and interline partners.

As part of our Sustainable Business Improvement Plan, we are working hard on improving despatch reliability and on time performance ('OTP'), key issues for our passengers. The first priority was to reduce the number of flight cancellations, particularly due to aircraft serviceability issues, resulting in a 35.3% improvement compared to the same period last year. However, arrivals OTP was 78.1%, 3.6 percentage points below last year. In part, this is because we have been making extra efforts to fly sectors and not cancel them, even if they run late. Poor weather and air traffic control issues have also been factors this year. Technical Despatch Reliability ('TDR') was 99.1% for the Q400 in the first half with a TDR for the Embraer jets of 99.3%.

In response to this we have worked alongside Bombardier to improve Q400 reliability, resulting in Q400 TDR improving by 10 basis points on last year. However, this resulted in increased maintenance expenses in Flybe UK. Maintenance costs have also been affected by the fall in the value of sterling, as most spare parts and rotables are priced in US Dollars, and the H1 cost associated with the handbacks. We are taking a fresh look at our maintenance strategy and operational processes to address the increase in maintenance costs and working with Bombardier on resolving common issues.

Plans have now further progressed on designing and scoping the new digital IT platform. As announced this week, Flybe will partner with Amadeus, the market-leading provider, to implement a new passenger service system which will provide customers with a significantly enhanced online experience from searching for a flight to landing at their end destination. This will help Flybe to drive additional revenues, improve efficiency and radically improve the online customer experience.

Revenue was up £35.5m against last year as a result of yield and load factor improvements, but costs were up by £43.0m to leave adjusted profit before tax down by £7.5m. The £5.4m one-off onerous IT contract provision, the c. £10m impact of the fall in the value of sterling and £9.5m of added maintenance costs were the principal factors in the increased costs and subsequent adjusted profit before tax decline. In order to drive a sustainable, profitable business there needs to be a relentless focus on costs. We will extend our focus on costs and accountability while working alongside our partners to ensure that we are working collaboratively to reduce costs.

Senior management team

To support the delivery of the Sustainable Business Improvement Plan, we have been building the leadership team. Ian Milne joined as Chief Financial Officer on 1st November after a brief time in an interim role. In addition, to help drive long-term thinking and planning, a new strategy team under the direction of Chief Strategy Officer Vincent Hodder is being put in place. Roy Kinnear, formerly Chief Executive Officer of Air Seychelles, will join the company as Chief Commercial Officer in January 2018. The new team brings significant expertise and experience into the business.

Outlook

The European aviation market continues to be challenging, with many airlines impacted by excess seat capacity in the short-haul market, a weaker pound and both business and consumer uncertainty. Within this market, the Board believes that Flybe offers a differentiated regional business model and has clear plans to deliver a sustainable profitable future helped by the plans to reduce capacity and cost.

Q3 Trading Update

Forward sales in Q3 as at 5th November 2017 have continued to be encouraging in the early weeks of the second half:

· 3% reduction in seat capacity vs. prior year

· 54% of seats sold vs. 50% in the prior year

· 9% increase in passenger revenue vs. prior year

Excluding the new Eastern risk-sharing flights, we are now planning for H2 capacity to reduce by around 4%, reflecting a smaller fleet and the latest winter schedule. This reduction is slightly lower than guided at the Q1 trading update to reflect our stronger H1 route performance and the absorption of the two ex-Brussels Airlines aircraft from the start of the winter season. Eastern flights add around 3% to capacity.

As of 5th November 2017, we had purchased 86.2% of our anticipated fuel requirements at USD499 and 93.4% of our anticipated US Dollar requirements at USD1.41 for H2 2017/18.

The information contained within this announcement is deemed by the Company to constitute inside information as stipulated under the Market Abuse Regulation EU no. 596/2014 ('MAR'). Upon the publication of this announcement via a Regulatory Information Service ('RIS'), this inside information is now considered to be in the public domain.