fastjet, the low-cost African airline, announces its audited final results for the year ended 31 December 2016.

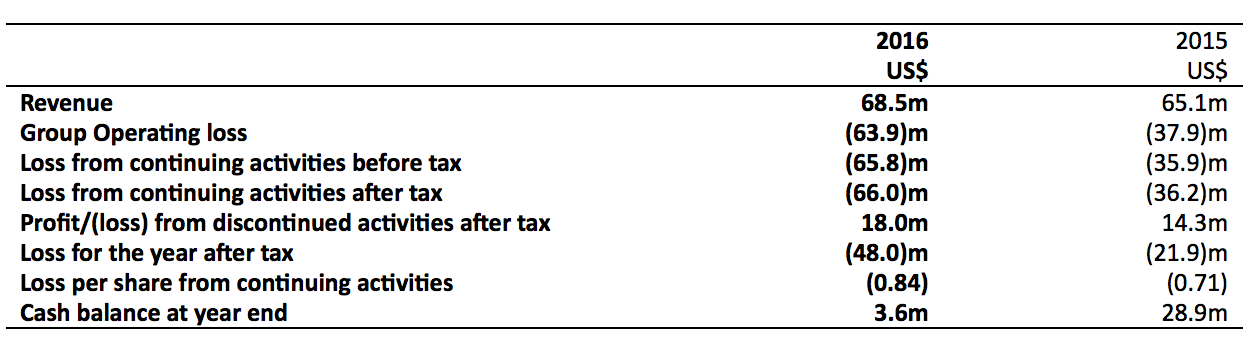

The table below shows the financial performance of the fastjet Group's continuing activities.

Strategic highlights

· Nico Bezuidenhout appointed CEO on 1 August 2016.

· Stabilisation Plan initiated comprising:

o Major cost reductions

o Fleet transition to smaller aircraft

o Head office relocation to Johannesburg

o Revenue initiatives including route rationalisation

· Successful capital fundraising of approximately US$20.0m before expenses in August 2016

· Strategic and operational partnership with Solenta Aviation Holdings concluded in January 2017 providing 3 E145 aircraft at reduced lease rates and Solenta acquiring a 28% shareholding in fastjet.

· Additional capital raise of approximately US$28.8m before expenses in January 2017, reflecting optimism in the strategic outlook for fastjet

Operational highlights

· Named Africa's Leading Low-Cost Airline 2016 at the World Travel Awards

· Revenues increased by 5% to US$68.5m (2015: US$65.1m), despite route rationalisation

· Passenger numbers up marginally at 783,317 (2015: 781,238)

· Aircraft utilisation constant year on year at 11.2 hours during peak months

· Costs increased by 29% caused by increased capacity and start-up losses on new routes in 2016

· Negative cash flow from operations of US$(52.3m) (2015: US$(36.9m)), primarily impacted by high costs mentioned above

Nico Bezuidenhout, fastjet Chief Executive Officer, commented:

"2016 was a challenging year and these financial results reflect not only a difficult market place but also the overly optimistic expansion plan adopted in early 2015.

Since I became CEO on 1 August 2016 we have successfully initiated a Stabilisation Plan to address the immediate challenges. However, although good progress has been made many of the Plan's benefits to reduce our cost base, and match capacity with demand, have naturally taken time to feed through and as such will only be materially realised in 2017. Nevertheless, the effects of the Stabilisation Plan in the second half of 2016 saw fastjet withdraw from a number of loss-making routes and remove surplus capacity such that while between July and December, capacity was reduced by 25%, passenger numbers were only down by 3% and revenues rose by 5%.

The final stages of the Stabilisation Plan are now implemented and the strong progress we have made means that fastjet's cost base will be significantly reduced by the third quarter of 2017 and that we are well on the way to fulfilling our baseline aim of achieving a cash flow break even position by the fourth quarter of 2017.

Since the year-end, fastjet has completed a US$28.8m fundraising, entered into a strategic and operational partnership with Solenta, and significantly strengthened our Board. With these initiatives building on the benefits of the Stabilisation Plan, and although a number of challenges remain, fastjet is now close to being sufficiently stable and well positioned to be able to consider disciplined growth opportunities in our target African markets."

fastjet's report and accounts for the year ended 31 December 2016 ("2016 Report and Accounts"), notice of the Annual General Meeting ("AGM") and the form of proxy, are expected to be posted to shareholders shortly.

A copy of the 2016 Report and Accounts will be available to view and download shortly from the Company's website: www.fastjet.com