HIGHLIGHTS

- In 2Q17, Embraer delivered 35 commercial and 24 executive (16 light and 8 large) jets, compared to the 26 commercial and 26 executive (23 light and 3 large) jet deliveries in 2Q16;

- The Company's firm order backlog ended the quarter at US$ 18.5 billion;

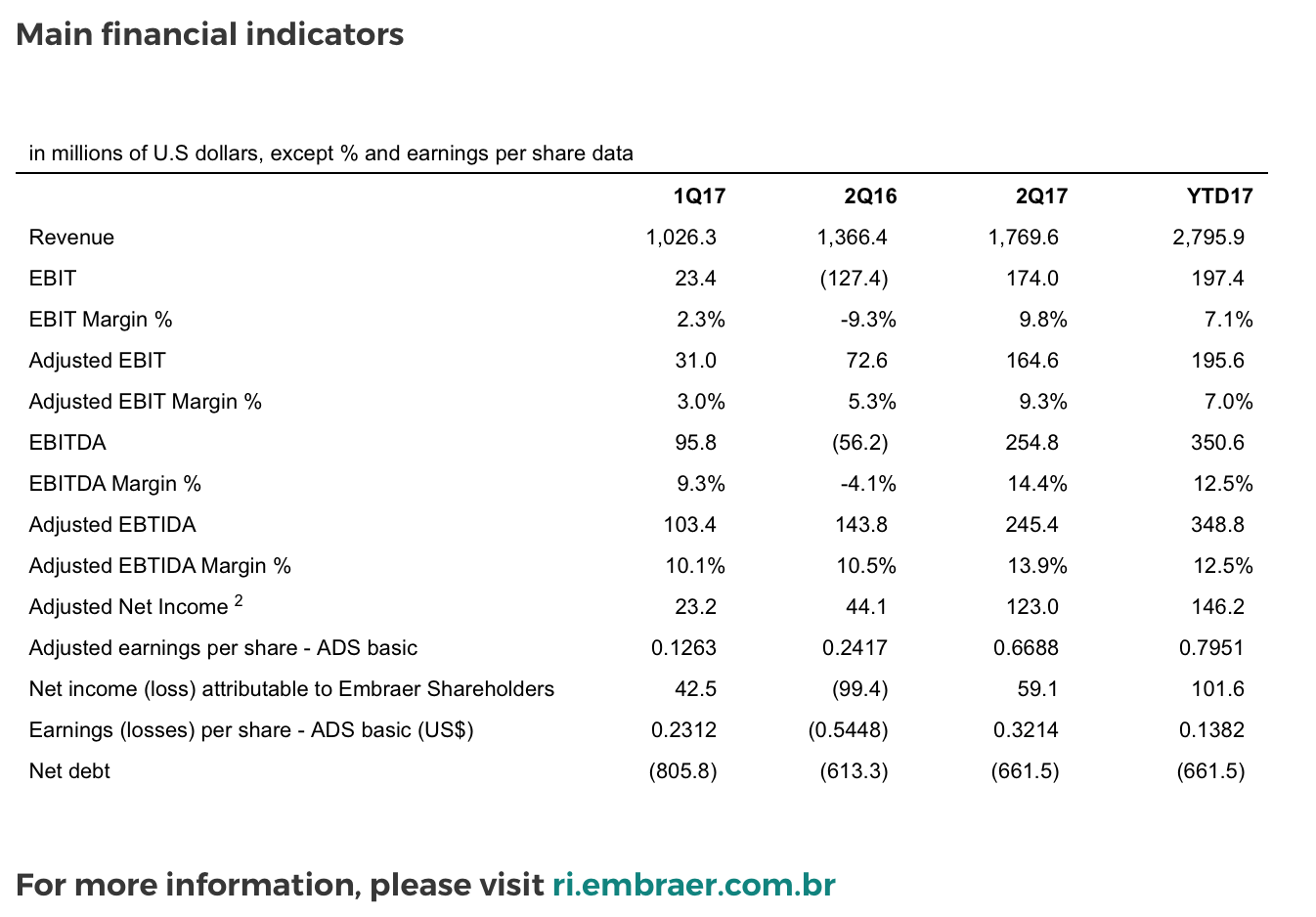

Revenues in 2Q17 increased 29.5% year-over-year to US$ 1,769.6 million, with significant growth across all three segments; - Adjusted EBIT and Adjusted EBITDA margins were 9.3% and 13.9%, respectively, in 2Q17, representing margin expansion compared to both the 2Q16 and 1Q17 consolidated results. Adjusted EBIT and Adjusted EBITDA exclude US$ 9.4 million in net non-recurring gains in 2Q17 and US$ 200.0 million in non-recurring charges in 2Q16. Adjusted EBIT and Adjusted EBITDA in the quarter were US$ 164.6 million and US$ 245.4 million, respectively;

- In the first half of 2017, Adjusted EBIT and Adjusted EBITDA margins were 7.0% and 12.5%, respectively. Accumulated Adjusted EBIT and EBITDA over the first six months of the year were US$ 195.6 million and US$ 348.8 million;

- 2Q17 Net income attributable to Embraer shareholders and Earnings per ADS were US$ 59.1 million and US$ 0.32, respectively. Adjusted Net income (excluding the impact of FX-related non-cash deferred income tax and social contribution and non-recurring items) for the quarter was US$ 123.0 million, representing Adjusted Earnings per ADS of US$ 0.67 per basic share in 2Q17;

- Embraer generated US$ 220.0 million of Adjusted Free cash flow during 2Q17, and over the first six months of 2017 Adjusted Free cash flow was US$ 20.7 million. The Company's net debt position improved to US$ 661.5 million at the end of 2Q17 from US$ 805.8 million at the end of 1Q17;

Embraer reiterates all aspects of its financial and delivery outlook for 2017.