EL AL (TASE: ELAL) reported of its Board's approval for the acquisition of Israir Aviation and Tourism Ltd. through its subsidiary Sun D'or, from IDB Tourism.

IDB Tourism will transfer to Sun D'or 100% of Israir shares in return for the allotment of 25% of Sun D'or shares, and in cash, equal to the value of the equity on the transaction's Closing date, in a total amount of up to USD 24 million.

After completion of the transaction, Israir will become a fully-owned subsidiary of Sun D'or, and Sun D'or will be jointly owned as follows: 75% by EL AL as the controlling shareholder and 25% by IDB Tourism.

The transaction is subject to a number of conditions, mainly the approval of the Antitrust Authority.

David Maimon, EL AL's CEO: "The transaction is an important step in the implementation of EL AL's long-term strategy of expanding and diversifying the range of services and products offered by the Company. The transaction will enable the Group to increase the Group's revenues and operations".

As part of the transaction, Sun D'or, EL AL's fully-owned subsidiary, shall purchase 100% of Israir shares, and, in return, EL AL will issue 25% of Sun D'or shares to IDB Tourism, in such a manner that EL AL becomes Sun D'or controlling shareholder, holding 75% of its shares, whereas IDB Tourism holds the remaining 25%.

The transaction shall include an injection of cash which will be equal to Israir's equity as of the Closing date and, in any event, will not exceed USD 24 million. EL AL's share of the said amount will be 75% and IDB's share will be, as mentioned above, at 25%.

Concurrently with the completion of the transaction, and subject to the Antitrust Authority's approval referred to above, Israir shall sell and leaseback the aircrafts it owns to third parties (an SLB transaction).

Furthermore, EL AL will receive a Call option to purchase IDB Tourism shares in Sun D'or (25%), and IDB Tourism will be granted a Put option to sell its shares in Sun D'or.

Simultaneously with the acquisition agreement, a service agreement will be signed between EL AL , Sun D'or and Israir , defining the types of services to be provided by EL AL to Sun D'or and Israir following completion of the transaction.

Israir is an Israeli private company, engaged in international and domestic flights as well as wholesale of vacation packages to international destinations, organized tours, package tours, skiing and more, under several brands, among them NATOUR, UNITEL, SKIDEAL and BISHVIL HAZAHAV. Israir is also engaged, through a holding in Diesenhaus Unitours Ltd. – a fully-owned subsidiary of Israir – in the sale and wholesale marketing in Europe of Israeli hotels (incoming tourism). In the course of its aviation operations, Israir mainly operates charter flights as well as scheduled flights to a number of destinations.

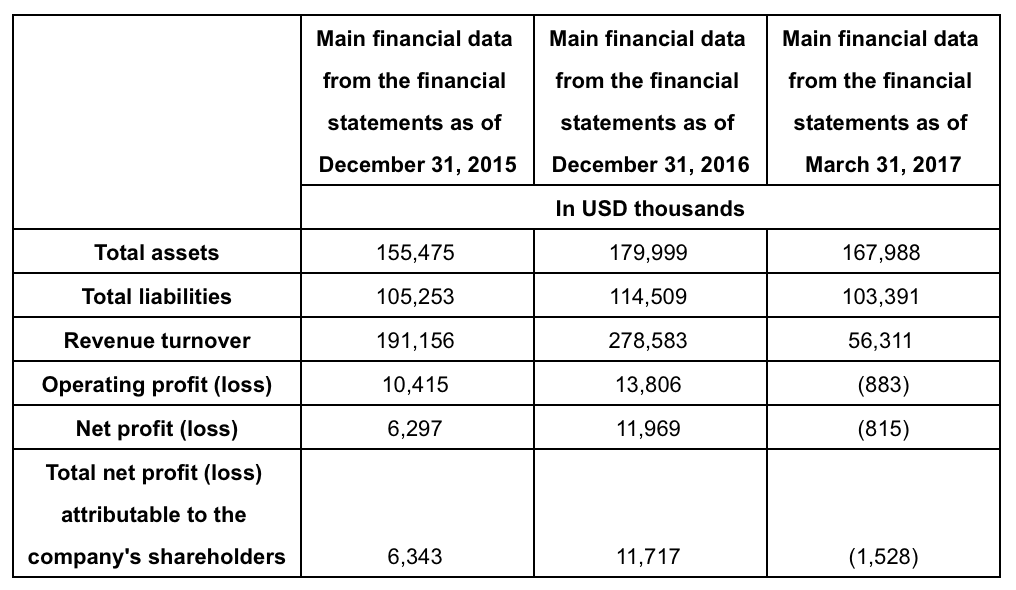

The main financial information taken from Israir financial statements for 2015, 2016 and the first quarter of 2017 are set forth below. Israir financial statements are based on acceptable accounting principles (IFRS):

The acquisition of Israir is a key step in El Al's strategy to expand its income resources and Non-Core Business, as well as diversify its operations by acquiring a prominent tourism activity, with extensive experience and professional knowledge. As well as to offer response to customers seeking tour packages to the Company's destinations, that is - the purchase of air tickets together with ground services and hotels, in the form of a One Stop Shop Service. Furthermore, increasing incoming tourism services to tourists arriving in Israel. To offer a diverse range of unique products such a ski deals. Expanding operations to EL AL's new vacation resorts and intensifying sales to EL AL's current destinations and to Increase the charter flights activity to wholesalers.

These actions will contribute to a growth in turnover, operations and number of passengers.

The foregoing includes forward-looking information, as defined in the Securities Law, 5728-1968, which may not materialize, or materialize partially or differently than specified, inter alia, due to a failure to obtain the approvals required to complete the transaction, including the Commissioner's approval, or changes in the consideration as a result of Israir financial expenses during 2017. This information does not replace the need to review the immediate report issued on the matter.