WILMINGTON, OH – November 6, 2017 - Air Transport Services Group, Inc. (Nasdaq: ATSG), the leading provider of medium wide-body aircraft leasing, air cargo transportation and related services, today reported consolidated financial results for the quarter ended September 30, 2017.

Compared with amounts for the third quarter of 2016 (except as noted):

• Revenues increased $60.8 million, or 31 percent, to $254.1 million. Excluding revenues from reimbursable airline expenses, revenues increased $49 million, or 29 percent. ATSG's dry leasing, and maintenance and logistics businesses recorded double-digit revenue increases before eliminations.

• GAAP Earnings from Continuing Operations were a loss of $28.2 million, or $0.48 per share diluted, compared with a positive $2.1 million, or $0.04 per share, in the year-earlier quarter. This quarter's earnings included non-cash after-tax charges totaling $43.1 million for revaluation of the warrants granted to Amazon Fulfillment Services, Inc. in connection with operating and lease agreements which began in April 2016, the amortization of lease incentives related to those Amazon warrants, a non-cash pension settlement charge, and other items. The value of the warrant liability increased versus the same period a year ago due to additional warrants vesting, and from calculating the value based on a 12 percent gain in ATSG's stock price during the third quarter.

• Adjusted Earnings from Continuing Operations, which exclude non-cash warrant, pension, and other items, were $14.9 million, up 72 percent. Adjusted Earnings Per Share from Continuing Operations were $0.22 for the quarter, up eight cents versus a year ago. The EPS calculation also reflects 9.9 million shares related to the warrants for the third quarter, versus 3.3 million a year ago. These Adjusted Earnings and other adjusted amounts referenced below are non-GAAP financial measures, and are reconciled to GAAP results in tables in this release.

• GAAP Pre-tax Earnings from Continuing Operations were a negative $20.8 million, versus a positive $3.1 million a year ago. Adjusted Pre-tax Earnings, which exclude warrant effects along with the pension settlement charges and other non-cash items, increased 58 percent to $24.0 million.

• GAAP Operating Income increased 31 percent to $18.9 million.

• Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization, as defined and adjusted in a table later in this release) increased 27 percent to $65.9 million versus a year ago, and increased $1.8 million from the second quarter of 2017.

• Capital expenditures through the first nine months of 2017 were $218.8 million versus $182.1 million in the same period of 2016. ATSG’s operating 767 freighter fleet has increased by six, to 58, during the first nine months of 2017.

Joe Hete, President and Chief Executive Officer of ATSG, said, “As we indicated in August, our adjusted results for the third quarter were very similar to those in the second quarter, and were up significantly from the third quarter a year ago. They reflect growth in our operating fleet and strong double-digit growth in associated lease revenues. We expect to deploy five more freighters to lease customers by year-end, and increase operating utilization for our CMI and ACMI fleets during a good peak season.”

ATSG's results for the first nine months of 2017 included a revenue increase of 36 percent to $745.2 million, and GAAP Earnings from Continuing Operations of negative $72.4 million, or a $1.23 per-share loss. Nine-months Adjusted Earnings From Continuing Operations in 2017 were $40.0 million, up 56 percent from a year ago. On a per-share adjusted basis, ATSG earned $0.60 per share, up from $0.39 in the first nine months of 2016.

In August, ATSG completed the purchase of an annuity contract that will pay pension benefits to nearly twelve hundred retirees of ABX Air. The transaction reduced ATSG’s exposure to future financial market fluctuations by applying pension plan assets towards the transfer of plan liabilities totaling approximately $100 million to a qualified insurer. The transaction will not affect pension benefits payable to eligible retirees. Accordingly, the Company's pretax results include a non-cash settlement charge of $12.9 million, of which $5.3 million was charged to continuing operations and the remainder to discontinued operations.

In September, ATSG completed a private offering of $258.75 million of convertible senior notes (including exercise of a $33.75 million greenshoe option) maturing in 2024. The notes have a coupon interest rate of 1.125 percent, and are convertible at a price of $31.90 per common share. In conjunction with the issuance of the notes, we also entered into related bond hedge and warrant transactions. Taken together, the bond hedge and warrant transactions are intended to prevent potential dilution of ATSG stock until its traded market price exceeds $41.35. Net proceeds of these transactions were used to reduce debt under the company’s revolving credit facility, and for other corporate purposes.

Segment Results

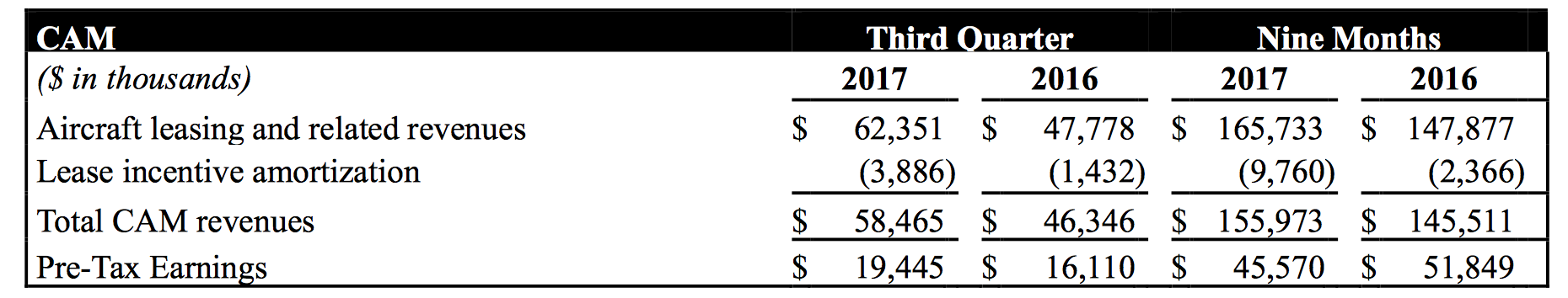

Cargo Aircraft Management (CAM)

Significant Developments:

• CAM's revenues increased $12.1 million, or 26 percent, to $58.5 million from the third quarter last year, and included $3.9 million of non-cash amortization associated with the warrant-related Amazon lease incentive. Excluding the amortization effects of this lease incentive, CAM’s revenues increased 31 percent. CAM was leasing forty-seven 767s to external customers as of Sept. 30, 2017, nine more than a year earlier. Two of those leases started during the third quarter. CAM leased one additional 767 to an ATSG airline during the third quarter.

• Pre-tax earnings were $19.4 million for the quarter, up 21 percent from $16.1 million in the third quarter last year. Principal contributors to the increase included the additional leased aircraft in service and higher revenues for engine maintenance services, offset in part by the warrant-related lease incentive, higher interest expense and increased depreciation from fleet expansion.

• At September 30, 2017, CAM owned seventy-four Boeing cargo aircraft, of which sixty-six cargo aircraft were in service, including fifty-eight 767s. Eight of the seventy-four aircraft were awaiting or undergoing modification from passenger to freighter configuration at the end of the quarter, including six 767s and two 737s. In addition to the six 767s in mod, CAM expects to close on purchases of five additional 767s in the fourth quarter of 2017. CAM will have eight 767s in cargo conversion at year-end, with all expected to be in service by the end of the third quarter of 2018.

• CAM expects to deliver three more 767s and two 737s during the fourth quarter. That includes the first of three 767-300 freighters for Northern Aviation Services, the remaining two of which are expected to enter service in early 2018. CAM also anticipates delivering a 767-300 to both Amerijet and Cargojet during the quarter.

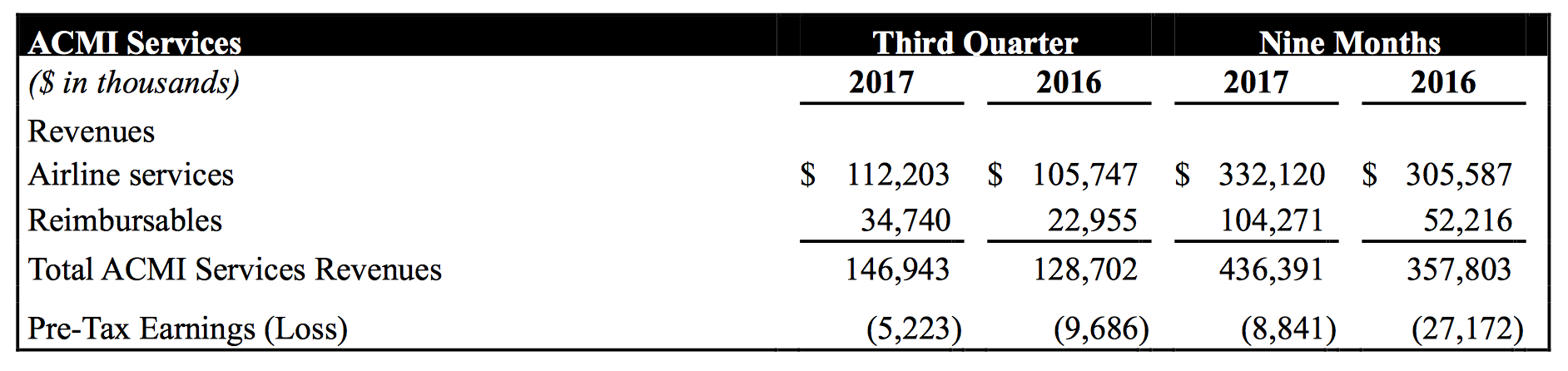

ACMI Services

Significant Developments:

• Airline services revenues increased 6 percent to $112.2 million and the segment recorded a pre-tax loss of $5.2 million in the third quarter. The reported loss included the previously mentioned non-cash pension settlement charge of approximately $5.3 million. Excluding this non-cash charge, ACMI Services results reflect significant improvement versus the prior-year quarter. Principal factors contributing to this improvement are increased revenues from additional CMI customer flying and reductions in pilot premium and training pay from year-ago levels.

• Pre-tax results for the nine months of 2017 improved by $23.6 million versus the prior year, excluding the aforementioned non-cash pension charge in the third quarter.

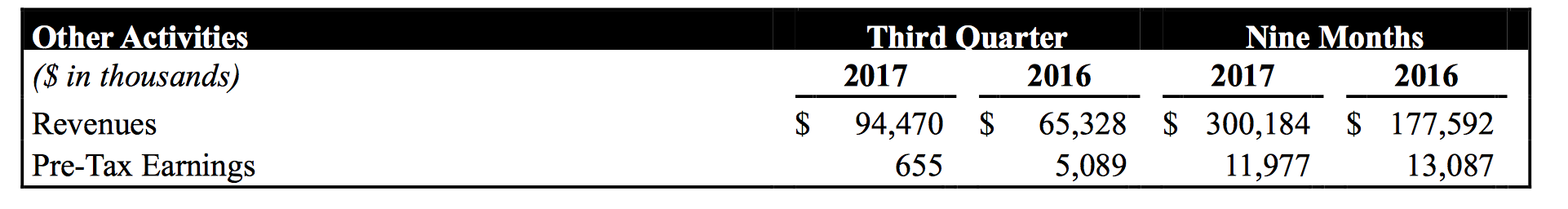

Other Activities

Significant Developments:

• Total revenues from all other activities in the third quarter were $94.5 million. External customer revenues increased by 81 percent versus the third quarter of last year to $66.2 million. PEMCO, acquired in December 2016, accounted for $7.9 million of external revenues during third quarter. Logistics services provided at gateways for Amazon were the single largest contributor to revenue growth in other activities versus the prior-year quarter.

• Third-quarter pre-tax earnings of $0.7 million were down sharply from a year ago, principally reflecting the termination of hub logistics support for Amazon in Wilmington last May, and the timing of completion of heavy maintenance services for AMES/PEMCO customers. Revenues are recognized by ATSG’s maintenance and repair subsidiaries when customer work is completed.

Outlook

ATSG continues to expect that its Adjusted EBITDA from Continuing Operations for 2017 will be approximately $260 million, or a more than 20 percent increase compared with the prior year, with all available aircraft in service during what is expected to be a strong peak season.

"Our outlook for peak season and early 2018 remains bright, as we continue to grow our portfolio of leased freighters, including our first two Boeing 737s," Hete said. "From September 30 this year though 2018, we will place at least eleven more Boeing 767 freighters in service, nine of which are committed to customers at this time. Our superior service performance, wide range of capabilities, and e-commerce-driven growth trends in the air express industry are continuing to attract new customers to ATSG."

ATSG continues to project 2017 capital expenditures of approximately $335 million, mostly for purchase and freighter modification of passenger aircraft.