Azul S.A., “Azul” (B3:AZUL4) NYSE:AZUL) the largest airline in Brazil by number of cities and departures, announces today its results for the fourth quarter of 2017 (“4Q17”) and for the full year 2017. The following financial information, unless stated otherwise, is presented in Brazilian reais and in accordance with International Financial Reporting Standards (IFRS).

Financial and Operating Highlights for 4Q17

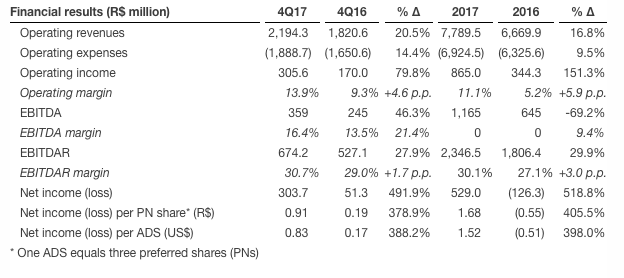

Operating income was R$305.6 million, representing a margin of 13.9% compared to R$170.0 million and a margin of 9.3% in 4Q16. This is a record fourth quarter operating result for Azul and was achieved even with the 16.0% increase in fuel prices year over year. Operating margin was 11.1% for the full year compared to 5.2% in 2016.

EBITDAR increased 27.9% to R$674.2 million, representing a margin of 30.7%, making us one of the most profitable carriers in South America.

Net income totaled R$303.7 million, representing an improvement of R$252.4 million over 4Q16. Net income in 2017 came in at R$529.0 million, compared to a net loss of R$126.3 million the year before.

Passenger traffic (RPKs) grew 12.7% on a capacity increase of 10.2% resulting in a load factor of 82.7%, 1.9 percentage points higher than in 4Q16.

Total revenue per ASK (RASK) increased 9.4% to 33.73 cents year over year even with a double-digit growth in capacity.

Net financial expenses decreased 34.4% from R$122.0 million to R$80.0 million.

At the end of 4Q17, our total cash1 position totaled R$3.6 billion, representing 45.7% of the last twelve months’ revenues.

Azul ended the year with a total debt position of R$3.5 billion resulting in an adjusted net debt to EBITDAR leverage ratio of 3.9x compared to R$4.0 billion and a leverage of 5.7x in 2016.

Azul’s operating fleet totaled 122 aircraft at the end of the quarter, including 12 next-generation A320neo aircraft.

On October 19th, Azul Investments LLP priced an offering of US$400.0 million aggregate principal amount of 5.875% senior unsecured notes due 2024.

TudoAzul recorded a 33.7% increase in gross billings (ex-Azul) in 2017 compared to 2016.

In December, Azul signed an MoU with Correios, Brazil’s postal service, for the creation of a private integrated logistics company. Azul will own 50.01% of the new company after the agreement is approved by Brazilian authorities.

Azul ranked as the most on-time airline in Brazil and the most on-time low-cost carrier in the Americas in 2017 according to OAG’s Punctuality League, the industry's most comprehensive annual ranking of on-time performance.

To retrieve the full version of this press release visit www.voeazul.com.br/IR

Management Comments

This was an outstanding year for Azul, and I would like to start by congratulating and thanking our crewmembers for their exceptional performance. We successfully achieved one of the highest margins in the region and remained committed to our industry-leading customer satisfaction and operating performance.

Throughout the year, we successfully executed our margin expansion plan consisting of three strategic pillars: replacing smaller aircraft with larger, more fuel-efficient next generation aircraft, growing our loyalty program TudoAzul, and expanding ancillary revenues. As a result, even with the increase in jet fuel starting in September, we ended the fourth quarter with an operating margin of 13.9% and delivered an 11.1% operating margin for the year, above the higher end of our guidance of 9% to 11% announced in early 2017.

Capacity grew 10.6% in 2017 mostly due to our upgauging strategy, and we were also able to increase RASK by a healthy 5.6%, resulting in a top line expansion of 16.8% year over year. In the fourth quarter, RASK grew 9.4% and revenue increased 20.5% year over year. Adjusting for the 10.3% increase in stage length, RASK went up by 15% in the last quarter of the year. We continued to have the highest average fare in Brazil of R$345 in the fourth quarter, an increase of 17.2% year over year.

The addition of next-generation aircraft to our fleet contributed to a 3.7% decrease in CASK ex-fuel, and as we move into 2018, we expect to continue seeing consistent margin expansion resulting from this fleet modernization process.

Our wholly-owned loyalty program TudoAzul maintained its strong growth pace, reaching over 9.0 million members. This represents an addition of two million members over the last twelve months, the fastest growth in our history. We have increased gross billings ex-Azul by 33.7% in 2017 compared to 2016, with the majority of this increase coming from sales to banking partners and direct sales to members, further increasing our share of the Brazilian loyalty market.

Our cargo division grew 49% year over year, as we continue to expand our network and capacity with the introduction of larger aircraft to our fleet. In December, Azul and Correios (Brazil’s Postal Service) signed a memorandum of understanding for the creation of a private integrated logistics solutions company to be controlled by Azul. Once approved by Brazilian authorities, both companies will have significant cost savings while increasing operating efficiency and maximizing revenue gains.

Our ancillary revenue growth also benefited from the implementation of new services to passengers, including a new baggage policy starting in mid-2017. We had minimum operational or customer disruption and are seeing baggage fee revenue ramping up as expected.

We continue to run Brazil’s most on-time airline operation. In 2017, our on-time rate was the highest among low cost carriers in the Americas according to OAG. Our superior customer experience was also attested by Skytrax’s award of Best Low-Cost Carrier in South America for the seventh year in a row and Best Airline Staff Service in the region for the second year in a row. In addition, TripAdvisor named Azul the third best airline in the world, a significant achievement on one of the world's most important travel sites.

In addition to delivering solid profits and the best operational performance in Brazil, we reduced our financial leverage and improved our debt profile through the successful conclusion of our IPO in April and the issuance of senior unsecured notes with favorable terms in October. Our total debt position decreased R$545 million or 13% at the end the year compared to 2016, while our liquidity position strengthened significantly to R$3.6 billion, representing 46% of our last twelve months’ revenue.

I thank you for your confidence in us. We will continue to strive to improve our financial results, operational performance and customer satisfaction levels beyond 2017 and remain focused on being the best airline for our crewmembers, customers and shareholders.

John Rodgerson, CEO of Azul S.A.