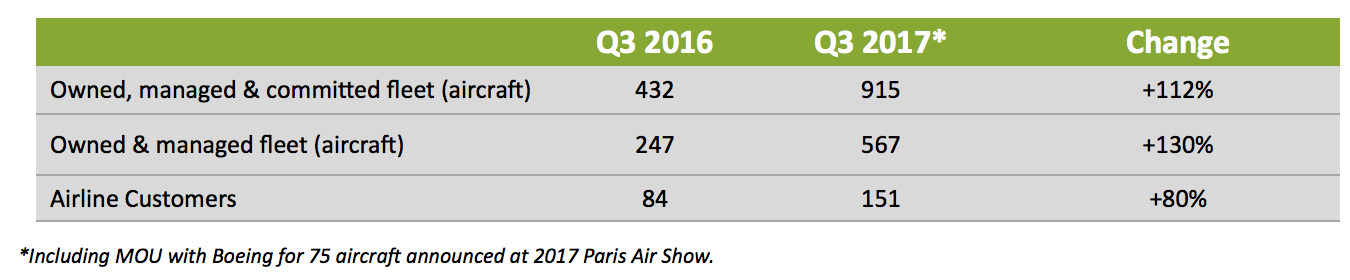

Dublin 4 October, 2017 | Avolon, the international aircraft leasing company, issues an update for the third quarter of 2017 (‘Q3’). Following another active quarter, Avolon’s owned, managed and committed fleet at the end of Q3 was 915 aircraft.

Q3 Business Highlights & Fleet Metrics

Ø Owned and managed fleet of 567 aircraft at end of Q3, with total orders and commitments for 348 new technology aircraft;

Ø Delivered a total of 10 aircraft, including 6 transitions, and sold 11 aircraft including 9 managed aircraft;

Ø Completed a total of 22 lease transactions in the quarter comprising new aircraft leases, second leases and lease extensions;

Ø Average owned fleet age of 5.1 years with average remaining lease term of 6.7 years at end of Q3;

Ø Total customer base of 151 airlines in 65 countries at end of Q3;

Ø Signed lease contracts with Azul Airlines for five Airbus A330-900neo aircraft, with delivery scheduled from 2018 onwards;

Ø Continued strong progress on placement of new order pipeline; as at the end of Q3, no aircraft from Avolon’s orderbook is available for lease until Q1 2019.

Ø CIT integration has been completed on target with all data migrated to independent Avolon operating systems and full integration of people, processes and a risk framework for the combined business; and

Ø Published a paper assessing the Boeing 737 MAX aircraft family titled The 737 MAX – Taking Flight. This paper analyzes the impact of the evolving changes to the MAX family’s composition on the narrowbody aircraft market.

Avolon Business Metrics | Q3 2017

Q3 Financial Highlights

Ø Year to date, Avolon has raised US$14 billion of total capital, as announced during the quarter. This includes both new equity and new debt, US$9.75 billion of which has been raised in the capital markets. Key developments during Q3 include:

• Successful closing of a private offering by Avolon of US$1.25 billion, aggregate principal amount, of unsecured senior notes, upsized from an initial target size of US$1.0 billion;

• Avolon repriced its US$5.0 billion TLB-2 with a tenor of 5 years, which was originally priced in March 2017 at LIBOR plus 2.75% with a LIBOR floor of 0.75%, to LIBOR plus 2.25% with a LIBOR floor of 0.75%. The repricing is expected to be completed on or about 4 October, subject to customary closing conditions; and

• Raised additional new debt during the quarter of US$629 million, providing additional financial flexibility.

Ø During the quarter, Avolon acquired the remaining minority interest shareholding in Hong Kong Aviation Capital Limited (‘HKAC’). As a result, Avolon now owns 100% of HKAC;

Ø KBRA issued a BBB+ investment grade issuer rating for Avolon, with a stable outlook;

Ø Moody’s Investor Service upgraded their corporate family rating on Avolon from Ba3 to Ba2, with a stable outlook;

Ø S&P Global Ratings upgraded its issue-level rating on Avolon’s 2022 and 2024 senior unsecured notes from BB- to BB, with a stable outlook; and

Ø Intercompany loans of US$365 million made to subsidiaries of Bohai Capital were repaid in full prior to the end of the quarter.