Importance and relevance of data has never been more profound than it is today. From selecting a garment online to a future life partner, data science, analytics and algorithms are becoming more prominent in decision making process. The dependency on data for making an informed decision is directly proportional to the severity of the outcome of that decision.

Aviation is the leading industry when it comes to emerging technologies which initiate downstream applications in other industries. Complex software programs and algorithms are widely used in predicting failures, simulating accident situations, deriving trends in aircraft utility and so on. But when it comes to aircraft values and valuations, there is still a considerable influence of human intelligence or “art” involved and is the primary method of presenting values to investors who fund this massive industry. This brings to the fore a key question – will data analytics, artificial intelligence and machine learning change the aircraft appraisal services and methods?

A peek into the past and the present:

It is a well-known fact that aircraft appraisals involve a large body of effort in studying the various factors affecting aircraft values. Macro factors such as global economy, fuel prices, supply and demand, emerging technologies, etc are all vast topics that require analysis when appraising the values of aircraft. Conventional methods of appraisals would address these factors on the basis of recent trends, which are readily available on subscription basis. To generalize, these parameters are already studied deeply and openly published. But, in our opinion, these factors are secondary when it comes to the actual value of the aircraft being appraised itself. Traditionally, different appraisers view these factors differently and the value attached to these factors largely varies from one appraiser to another.

By virtue of being a machine, aircraft values follow a normal depreciating curve through their economic lives. As with any technology, disruptive emerging technologies tend to shorten the economic viability of the aircraft type significantly. External factors like global economy, fuel prices, material costs lead to more sustainable aircraft which can stand the test of time and continue to yield profits for those who invest in them.

However, operational challenges and the technical issues have their fair share in deciding the impact on assets being traded and the values that they get traded at. Typically, when portfolios of aircraft are traded, the entire portfolio is evaluated based on the general maintenance status of the aircraft, their age and type, specifications and open source information on OEM recommendations / enhancements that each of the asset possesses, etc. However, rarely does the appraisal study include analysis of technical issues related to the aircraft type and its impact on the value. This study would essentially reveal alternate trends regarding the aircraft being traded, which conventional methods may not necessarily highlight.

Physical inspection findings and their impact on aircraft values:

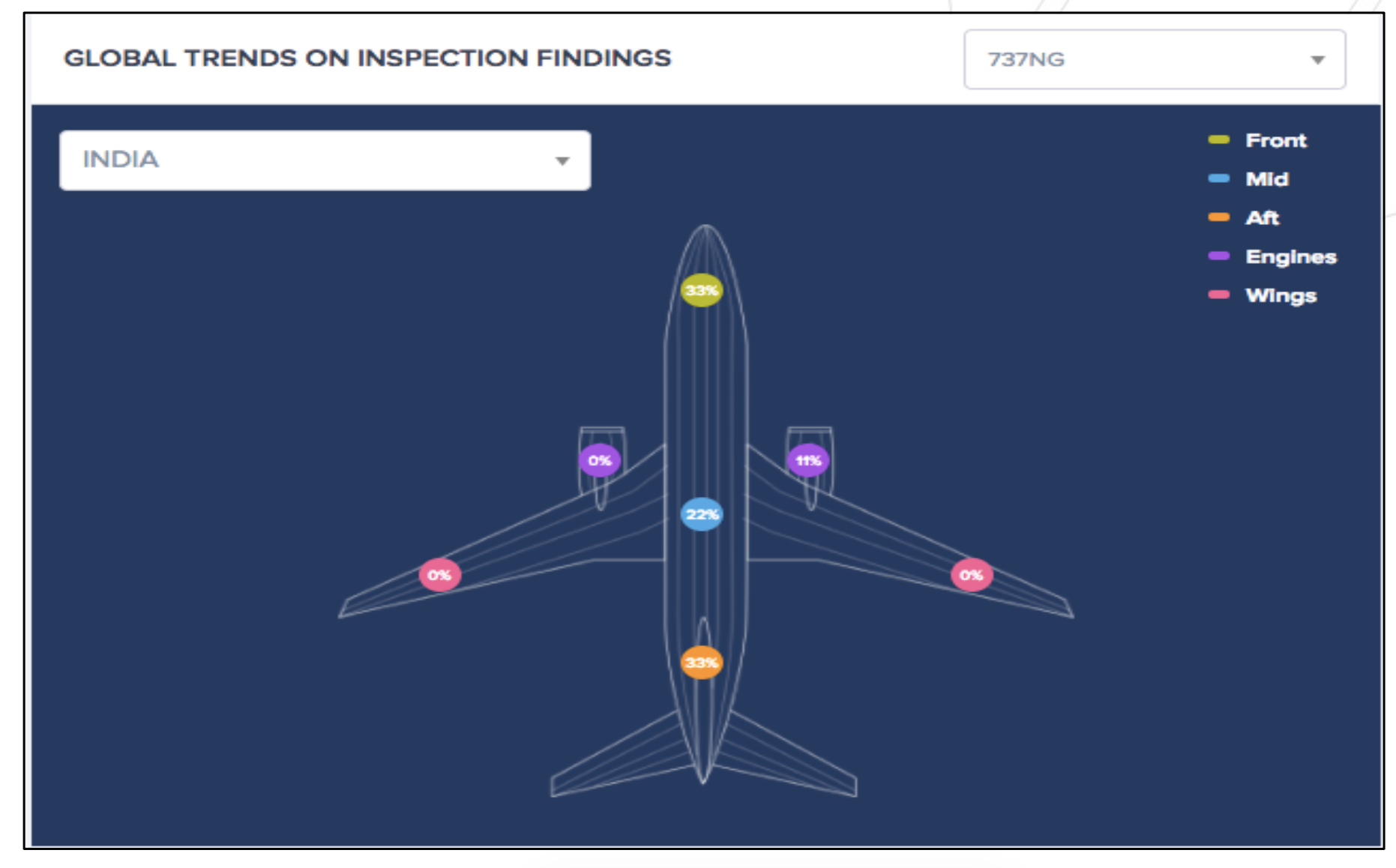

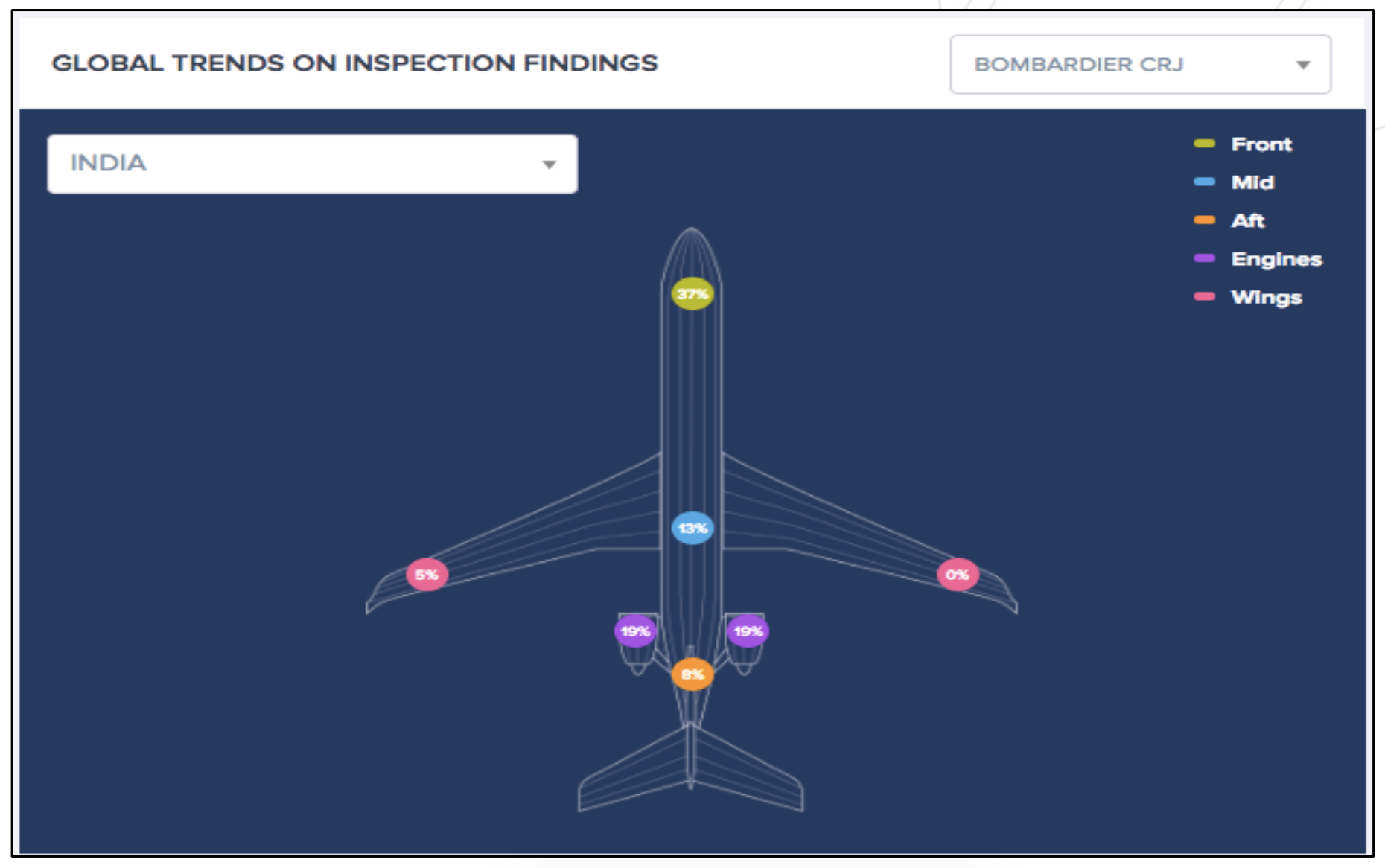

Diving deeper into this discussion, technical inspections of various aircraft in varying global environments can yield valuable data points to predict issues relating to the aircraft. At Acumen, using innovative inspection techniques and complementary software programs, we were able to collate data from hundreds of aircraft inspections performed across the globe. The results are exciting. After feeding in the “findings” observed by the technical inspectors during inspection of the aircraft, we are able to identify visible trends in specific areas of concern with specific geographical areas. Further analysis of these trends can then depict the severity of these findings with regards to age of the aircraft and conversely with the airline customers that operate those aircraft in respective geographical locations. This kind of information can play a vital role in deciding appropriate value deductions on aircraft included in a portfolio of assets, which have not been inspected as part of the appraisal assignment. Although the amount to be deducted may still be an opinion of the appraiser, the basis for the deduction will be justifiable and supported by valid data points – collected over a considerable number of actual inspections performed.

If one looks closely at the figures below, the trends are very evident with regards to findings on specific areas of different types of aircraft operating in India. Source: Acumen Aviation database*.

Lessees and impact on securitization:

An allied area of inspection is the airline that is operating the aircraft. It is becoming a rarity to see naked aircraft being traded on the market today. Most sale transactions are with a lease attached. Based on the views of various industry experts, there is an increasing need to provide lease encumbered values instead of standard current market values which basically assume a single unit sale transaction of a “naked” aircraft. Obviously, when we discuss lease encumbered values, it may be prudent to look at the lessee itself and attach some level of monetary value to the aircraft value based on the lessee’s capabilities and maintenance practices.

Most investors and financiers would have their own internal processes to rate lessees and cover the credit risk associated with the lease. However, that necessarily does not cover the technical risk associated with leasing the aircraft to the subject lessee. Similar to collecting data points on findings associated with aircraft physical condition, there are parameters associated with gauging the overall capability of the lessees as well. A simplified score sheet based on specific areas of operations and maintenance would be able to paint an accurate picture of the lessee’s maintenance and operational capabilities. This would allow investors in controlling exposure, maintaining oversight on the aircraft on lease, cover risk adequately from the beginning and allow due consideration during the sale transaction.

Once again, the onus of attaching an appropriate value for adjustment lies with the appraiser. However, accurate data points provide the justification for such value adjustments and offers reliable evidence for the appraiser’s views. Source: Acumen Aviation database*.

Challenges in using data analytics

All data analytics tools are based on algorithms and algorithms are “literal”. Algorithms provide exact results depending on the purpose that they are designed for. But in doing so, a poorly defined purpose for a brilliantly designed algorithm will still provide erroneous results. So it is very essential that the data analytics tools being designed have a well-defined purpose.

Algorithms are equivalent to “black boxes” in the sense that they tend to predict the future accurately but rarely explain what will cause an event or why. So understanding these limitations of algorithmic analytics is the first step towards managing them and using them optimally.

This cannot be more true when it comes to Aviation. With a projected fleet of more than 40000 commercial aircraft by 2033 (as per the various market forecast projections from aircraft OEMs such as Boeing, Airbus and Embraer), the amount of data that will be generated is bound to be enormous, providing an opportunity to mine useful information using latest analytical software tools.

Concluding remarks

Drawing attention to the question that was posed in the opening paragraph of this article, data analytics and artificial intelligence capable of making predictions do not eliminate the need for care in connecting the cause and effect. These are surely not a replacement for controlled analysis and measured opinions which are at the core of aircraft appraisals. But they can do what is extremely powerful: identify patterns too subtle to be detected by human observation; using those patterns generate accurate insights; provide basis for the opinions and lastly, assist better decision making. With growing need for automation, there will be a necessity for analytics to play a prominent role. With effective management of the limitations and input of accurately fed data, the true potential of data science can be achieved in the aircraft appraisal industry.

Please write to info@acumenaviation.in or ameya.gore@acumenaviation.in if you would like to get in touch to discuss more about the topic, or for any appraisal requirements.