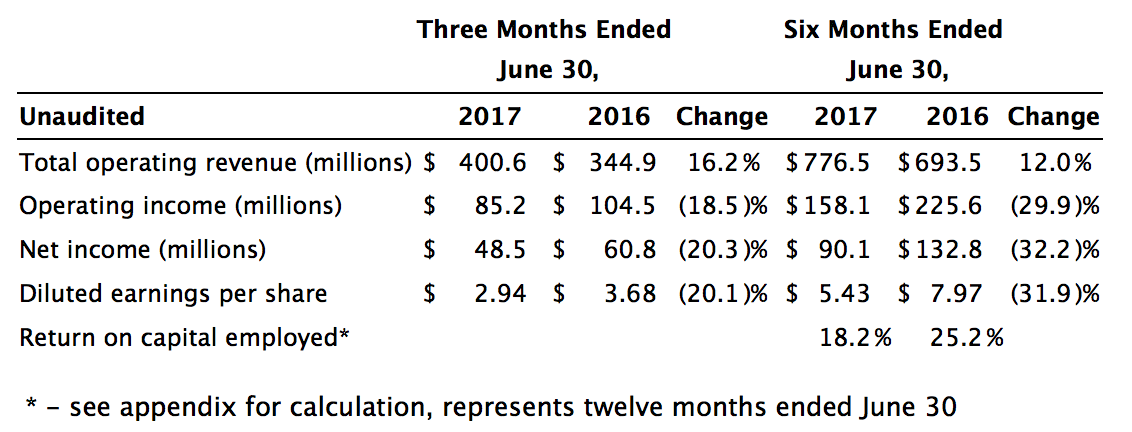

Allegiant Travel Company (NASDAQ:ALGT) today reported the following financial results for the second quarter 2017, as well as comparisons to the prior year:

“I am pleased to announce we had our 58th consecutive profitable quarter," stated Maurice J. Gallagher Jr., chairman and CEO of Allegiant Travel Company. "I am also pleased with our 21.3 percent operating margin during this transition time for the company. We are well into the wind down of our MD-80 fleet. We have taken delivery of our first four new 186 seat A320 aircraft from Airbus as of July 26th. We expect to place into service another ten Airbus aircraft including six more new A320s throughout the remainder of 2017. We also signed an agreement to acquire an additional 13 used A320s which we announced in June 2017. This was the last transaction needed to solidify the plan to retire all the MD-80s by the end of 2019. Thank you to all of our team members for another successful quarter."

Notable highlights

- Airbus growth - In June, announced the lease arrangement of 13 used A320 aircraft to be delivered in 2017 and 2018. Will take the company to 92 committed Airbus either in service or for future delivery

- Network growth - As of June 30, 2017 the company is operating 382 routes versus 342 at the same time last year

- New routes - Announced 28 new routes expected to begin in the third and fourth quarters of 2017

- Includes new cities of Milwaukee, Wisconsin; Norfolk, Virginia; and Gulfport, Mississippi

- Shareholder returns - $92 million was returned through a combination of the recurring dividend paid in June 2017 and share repurchases during the quarter. The company:

- Will pay a dividend of $0.70 per share on September 5, 2017 to shareholders of record as of August 18, 2017

- Returned $84 million to shareholders through the repurchase of 589,000 open market shares in the quarter. This was the highest dollar amount spent in share repurchases for one quarter in the history of the company

- The Board of Directors increased the share repurchase authorization to $100 million

Second quarter 2017 revenue

- TRASM results - Second quarter TRASM increased 3.1 percent

- Impact of Easter shift into April this year benefited the quarter contributing approximately 1.5 percentage points of TRASM

- New markets (markets operating less than one year) were approximately thirteen percent of ASMs for the second quarter which is similar to last year

Third quarter 2017 revenue trends

- TRASM guidance - Third quarter TRASM is expected to be between negative .5 and positive 1.5 percent versus the third quarter last year

- Increased MD-80 spares, which limits the ability to grow peak period flying, is expected to cost the third quarter one percentage point of TRASM

- Off peak flying is expected to be almost 26 percent of ASMs for the third quarter, versus approximately 22 percent last year

Second quarter cost trends

- Second quarter CASM ex fuel increased 13.2 percent versus the same period last year driven by:

- New pilot agreement - Added six percentage points

- Elimination of the credit card surcharge - Added four percentage points

- In January 2017, we discontinued our credit card surcharge, which had previously been applied as a reduction to sales and marketing expense

- Irregular operations - Added two percentage points

Third quarter 2017 cost trends

- Third quarter 2017 CASM ex fuel is expected to increase between sixteen and eighteen percent versus the same period last year, driven by:

- New pilot agreement - Expected to add three percentage points

- Incremental depreciation on Airbus aircraft - Expected to add three percentage points

- Elimination of credit card surcharge - Expected to add three percentage points

- Transition costs - Cost related to the fleet transition such as reduced ASMs through less utilization of MD-80s and other operational inefficiencies driven by the move to an all Airbus fleet is expected to add five percentage points

Full year 2017 cost trends

- Full year 2017 CASM ex fuel is expected to remain up between ten and twelve percent, consistent with prior guidance

- Maintenance and repairs expense is expected to remain between $100 and $110 thousand per in-service aircraft per month for full year 2017, consistent with prior guidance

- Total ownership expense per aircraft per month - Full year 2017 ownership expense per in-service aircraft per month is expected to remain between $125 and $135 thousand, consistent with prior guidance

Balance sheet activity and full year 2017 trends

- Full year CAPEX guidance (Excluding Airbus deferred heavy maintenance) is expected to be $525 million, consistent with prior guidance

- Raised $113 million in debt proceeds during the second quarter

- Currently have five unencumbered Airbus aircraft