BURLINGAME, Calif., March 06, 2018 -- AeroCentury Corp. (NYSE American:ACY), an independent aircraft leasing company, today reported fourth quarter earnings of $6.02 million, or $4.25 per share, compared to $385,000, or $0.27 per share in the third quarter of 2017 and a loss of $40,000, or $0.03 per share, in the fourth quarter of 2016. Fourth quarter 2017 results included a $5.4 million tax benefit from the revaluation of the Company’s deferred tax liability caused by of the passage of the Tax Cuts and Jobs Act of 2017.

Earnings for 2017, which included the $5.4 million tax benefit noted above, totaled $7.4 million, or $5.10 per share, as compared to $1.2 million, or $0.78 per share for 2016.

“Modernizing our portfolio by replacing older aircraft with younger mid-life aircraft remains a priority,” said Michael Magnusson, President. “During the fourth quarter, we sold two regional jets, one turboprop aircraft, one engine and aircraft parts, generating a net gain of $922,000. To date, in 2018, we have already sold two aircraft, generating a $45,000 gain. The average age of aircraft we are holding for lease is currently approximately 11 years.”

As previously reported, AeroCentury Corp. announced on October 26, 2017 the signing of a merger agreement to acquire JetFleet Holding Corp. (JHC), which has managed the Company’s operations and aircraft portfolio since AeroCentury’s founding in 1997.

“Our acquisition of JHC is proceeding on schedule,” Magnusson continued. “After a fairness hearing on February 22, 2018, the California Department of Business Oversight issued a permit for the issuance of securities in the transaction, and the solicitation of consents of JHC shareholders to the acquisition has begun. We believe the merger will be accretive to earnings and expand our access to capital sources.”

Fourth Quarter Highlights

Sale of an older turboprop aircraft, two regional jet aircraft and an engine, generating total gains of $0.9 million

Operating lease revenue of $7.0 million

Operating margin1 of 10%

Increased EBITDA2 of $6.4 million compared to both the preceding quarter and the year-ago quarter

$5.4 million tax benefit as a result of tax law changes, which will also result in an expected decrease in the Company’s federal tax rate from 34% to 21% beginning in 2018

Book value per share of $33.43 at year-end

91% portfolio utilization

$36 million of available liquidity under revolving credit facility at year-end

Fourth Quarter 2017 Comparative Data (at or for the periods ended December 31, 2017, September 30, 2017, and December 31, 2016):

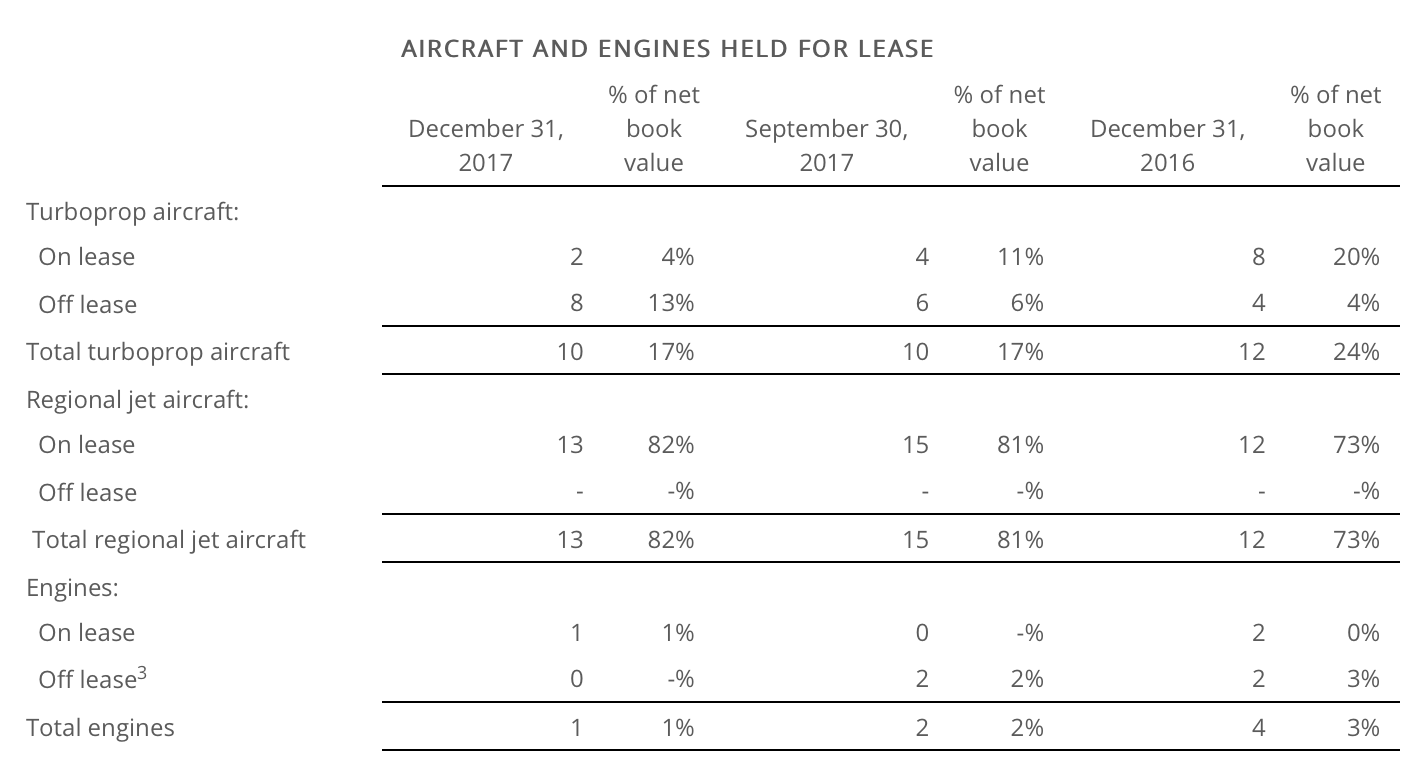

Average portfolio utilization was 91% during the fourth quarter of 2017, 93% in the third quarter of 2017 and 94% in the fourth quarter of 2016.

Total revenue increased 34% to $11.2 million for the fourth quarter of 2017, compared to $8.3 million in the preceding quarter, and grew 45% from $7.7 million in the fourth quarter a year ago.

- Operating lease revenues decreased 7% to $7.0 million in the fourth quarter of 2017 from $7.6 million in the preceding quarter and decreased 5% from $7.4 million in the year-ago quarter, reflecting assets sales during 2017.

- Operating lease revenues accounted for 63% of total revenues in the fourth quarter of 2017, compared to 91% in the third quarter of 2017 and 96% in the year-ago quarter.

- Maintenance reserve revenue contributed $2.9 million to fourth quarter revenues compared to $350,000 in the preceding quarter and $0 in the fourth quarter a year ago.

- During the fourth quarter of 2017, the company recognized $922,000 in gains from disposal of assets, compared to $3,000 in both the third quarter of 2017 and the fourth quarter of 2016.

Total expenses increased 31% to $10.0 million from $7.6 million in the preceding quarter and increased 30% from $7.7 million in the year-ago quarter, primarily due to higher maintenance costs and the provision for impairment.

AeroCentury's portfolio currently consists of twenty-one aircraft and one engine that are held for lease and nine aircraft that are held under sales-type or direct finance leases. The Company also has two turboprop aircraft that are held for sale, which are being sold in parts.

The Company's portfolio consists of eleven different aircraft types. The current customer base comprises nine airlines operating in eight countries.

The following table shows the status of the Company's portfolio of aircraft and engines held for lease as of December 31, 2017, September 30, 2017, and December 31, 2016.